A "recommendation" and a guide

Video Market Update May, Liquidity Corner, Meet our client, Crypto self-depositors are actually masochists, memes

Let’s gooo 🎢 What to expect:

Knowledge-Level : 🟢 Beginner| 🟡 Advanced | 🔵 Expert

Insight DeFi on Social Media: LinkedIn / Instagram / Twitter / YouTube / Telegram

🟢 Video Market Update May

recorded by Pascal Hügli

Towards the end of the week, equity markets rallied, and the volatility index closed lower than it has in months. Is this just the blow-off top before the wind shifts with the wave of new incoming U.S. debt issuance? In this video market update, we look at the U.S. debt ceiling, why it's not really a ceiling, and what the temporary lifting of the debt ceiling will bring to the equity markets and crypto assets. In addition, we look to Asia, where Hong Kong is opening up the crypto market to institutional as well as retail investors. We also look at the LSDFi market, arguably the hottest thing in the crypto world at the moment. Memecoins, the innovations around DeFi on Bitcoin, and the emergence of real-world assets (RWAs) are also a topic.

🟢 Liquidity Corner: On the crucial question of upcoming government financing

written by Pascal Hügli

A look at the numbers:

Net financial liquidity in the U.S. (with the BTFP emergency lending program):

May 18 (past newsletter issue): $6,141 billion

June 01 (current newsletter issue): $6,239 billion

↗️ Increase of $96 billion.

Broken down even further here:

Total balance sheet of the Federal Reserve:

May 17 (past newsletter issue): $8,456 billion

June 01 (current newsletter issue): $8,385 billion

↙️ Reduction of $71 billion

Reverse repo programs in the U.S:

May 18 (past newsletter issue): $2,238 billion

June 01 (current newsletter issue): $2,160 billion

↙️ Reduction of $78 billion

U.S. Treasury General Account (The U.S. gov's “bank account” at the Federal Reserve):

May 18 (past newsletter issue): $57 billion

June 01 (current newsletter issue): $37 billion

↙️ Reduction of $20 billion

Over the past two weeks, overall liquidity in the U.S. financial system has increased. The Federal Reserve's balance sheet has continued to shrink as part of the ongoing QT policy. However, this reduction has been offset by the TGA, emergency lending, and reverse repo programs.

In a few days, the increase in the debt ceiling for the U.S. government should be a done deal. Once this is the case, the Treasury will be able to borrow again or rather go on a borrowing spree. The expectation is that a total of one trillion U.S. dollars in new debt will come onto the market this year. And next year, the U.S. government is even aiming to raise $1.5 trillion in debt.

Depending on how the U.S. Treasury will manage this new debt, the consequences for the liquidity situation may vary. The key will be:

How fast will the Treasury refill its account (liquidity drain)?

To what extent will they manage to suck liquidity out of reverse repos rather than banks?

If the money flows from money market funds into the new government debt – there is currently over $2 trillion parked at the Fed – the effect on liquidity should be rather neutral. However, this money will only be redeployed if the yields on new debt are higher than the interest rates on reverse repo programs.

It is likely that some (how large of an amount is the question) of the capital will come from the banks in the form of bank reserves. If the money shifts from the commercial banks' bank account (bank reserves) at the Fed to the U.S. government's bank account at the Fed (TGA), the result is an increase in the latter at the expense of the former. A reduction in bank reserves, in turn, would have to lead to a reduction in financial liquidity. Indeed, banks would have less capacity available for financing and lending. Ergo, liquidity and thus also the potential for risk assets to find a favorable environment would wane.

Over the next few weeks, it will be exciting to see where the money will actually come from in the financing of the new U.S. government debt. Depending on the outcome, this will affect the market prices of equities and other risk assets such as cryptoassets differently. From an investor's perspective, it is important to monitor this development closely and continuously do proper risk management.

🟢 The Staking and Liquid Staking Ecosystem

written by Julian Richter

This article introduces you to the fascinating world of Staking and Liquid Staking. This gives the reader a comprehensive introduction to these topics, an exciting overview of the diverse staking and liquid staking ecosystem, and a practical 7-point guide to help select a suitable staking provider. Let's go.

What is Staking?

Staking, also known as proof-of-stake (POS), is a consensus mechanism for validating blockchain transactions. Staking service providers are known as validators. In addition to the proof-of-work mechanism (as used in Bitcoin), POS is widely used and constantly evolving, as we see in the area of liquid staking.

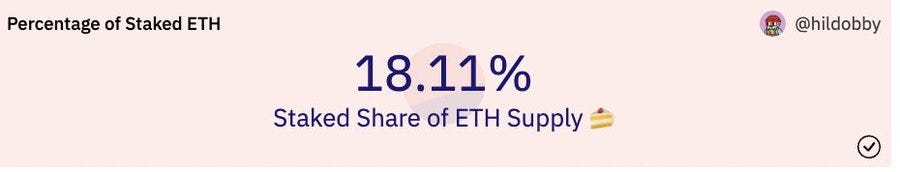

POS allows coins (e.g., ETH) to be delegated directly from a personal non-custodial wallet to a staking service provider or validator. There are many instructions online on how to use a wallet and perform the delegation. Alternatively, one can have their coins delegated by a centralized service provider (custodial wallet), such as a centralized custody provider or crypto exchange.By delegating the staking tokens to a validator, one contributes to the security of the POS network. The more token holders delegate their tokens, the more secure the network becomes. In the Ethereum network, for example, about 18% of all circulating coins are delegated to a validator or liquid staking provider as of today, and the trend is rising:

With delegation, the coins remain in the user's own wallet, but are blocked for the staking period and delegated to the corresponding validator. The private key (which enables access to the coins on the blockchain) remains with the user and is not passed on to the staking service provider.

As a holder of coins on a proof-of-stake blockchain, one can delegate the coin to the address of a validator. This validator is a professional staking service provider. If, on the other hand, one has sufficient technical knowledge and resources, one can also operate one's own validator infrastructure and delegate the Coins to one's own validator address. This in turn contributes to the decentralization of the POS network. However, setting up a validator on Ethereum requires ownership of 32 ETH, a sum that is substantial these days and may be out of reach for many users.

Staking rewards are received for contributing to POS network security. These can vary from 5% to a few 100% depending on the market and network (depending on the project). A good overview of this can be found here. Of course, staking also comes with risks that you should be aware of:

Re-delegation period: should one decide to redelegate the tokens from one validator to another (re-delegation), this process can take up to 30 days. During this period, the tokens are locked and cannot be traded or used in any other way. This can be especially problematic when the market is volatile, and you want to react quickly.

Slashing: Slashing is a penalty introduced on proof-of-stake blockchains to protect the network from fraudulent behavior. If a validator attempts to validate fraudulent transactions (double-signing) or if it is offline for an extended period of time (downtime), it can have a portion of its staked tokens taken away (slashing). This can also have an impact on the delegators, as their delegation and rewards can be reduced accordingly.

What is Liquid Staking?

Liquid Staking is an innovative method that increases the liquidity of staked assets, expanding the use and utility of PoS networks. In traditional staking scenarios, tokens are locked during staking and cannot be used for other purposes. Liquid Staking changes this by allowing users to receive representative tokens in exchange for their staked tokens. These tokens are also called Liquid Staking Derivative, or LSD. One receives this token as confirmation of their deposit and can trade this token 24/7, thus remaining liquid.

In addition, LSD can be traded, used in DeFi applications, or used for other purposes while the original tokens continue to be staked and generate rewards. This overcomes the liquidity constraints of traditional staking while maintaining the security and functionality of the PoS network.

It is actually possible to earn both staking rewards and additional DeFi rewards, which can increase your overall return on investment. However, it's important to note that this also brings increased risk, as this adds additional smart contracts and services to the process. These additional components could be potential points of attack or be prone to errors, which could lead to losses. Therefore, it is essential to conduct a careful risk assessment and familiarize oneself with the mechanisms involved before deciding on such a strategy.

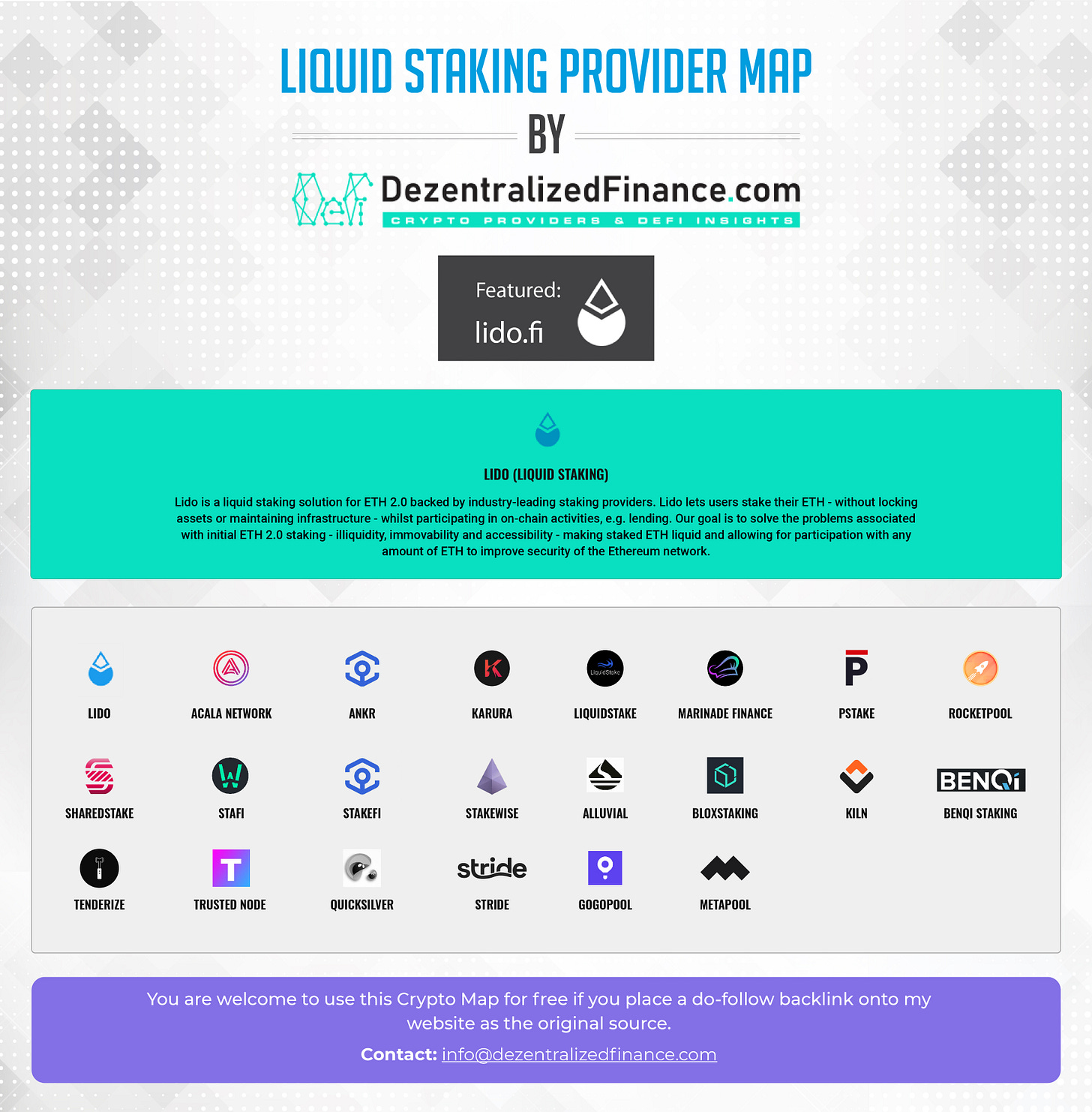

Well-known liquid staking services include Lido, Rocket Pool, Quicksilver and Stride. Here is an overview of all relevant liquid staking providers.

Staking and Liquid Staking Ecosystem – An Overview

The staking and liquid staking ecosystem is constantly evolving. At DecentralizedFinance.com you can find an overview of the global staking provider and liquid staking provider market. Some of the most notable liquid staking providers are:

How to choose a Staking Provider / Validator: A 7-point guide

Continuous availability: a professional staking service should guarantee an availability of 99.9% or more. Availability is an indicator of the reliability of the service. Downtime can lead to so-called “slashing”, which costs both return on investment and reputation.

Slashing history: The history of slashing incidents is important. Slashing is the punishment of a validator who was either unavailable or made errors in signing blocks. Such errors can happen unintentionally or intentionally, but most often they are unintentional.

Establishment date: It should be checked when the staking service was established and when it started. The longer a service has existed and the more staking networks it supports, the more reliable and trustworthy it is likely to be.

Financial background: Does the staking service have a solid financial basis? So it is important to get an idea about the financial situation of the platform.

Governance support: does the staking service support the governance of the various staking networks? How actively does the service engage in promoting governance proposals and encouraging decentralization?

Community: also, one should explore the community of the service on various platforms such as podcasts, websites, Telegram, Discord, etc. This can give one a sense of the growth and reputation of the service.

Team: Similarly, the team behind the Staking service needs to be sifted through. A look at the validator team and the founders helps to spot their experience and expertise.

Summary Staking and Liquid Staking

Staking and liquid staking have evolved significantly in recent years and are a critical part of the crypto ecosystem as basic infrastructure.

Maximum Extractable Value (MEV): this concept refers to the potential profit from manipulating the order of transactions. It is a controversial issue that could affect the fairness and security of networks.

Decentralized validator technology: projects such as the Shared Validator Network (SSV) and Obol aim to promote decentralization at the validator level and reduce risks in the validator business.

Staking Regulation: the staking market is largely unregulated, but regulators are starting to pay attention to this sector. Future regulations could impact the growth of the staking market.

Overall, the staking and liquid staking market is in an exciting phase, driven by technological innovation and regulatory trends.

About Julian Richter:

Julian Richter is a staking expert from Germany and maintains the website decentralizedfinance.com. At the same time, he serves as Head of Sales and Business Development of Tangany, a digital asset custodian.

🟢 Meme Section

How do you recognize a Bitcoiner? By knowing his car...

It's not a meme, it's truflation!

I don't drink cider, but this one maybe:

The revolution is near: