All eyes on Bitcoin and crypto AGAIN?

Fed bluffing, ticket competition, fan tokens and football NFTs, media appearance, and Bitcoin as the new Swiss bank account

Let’s gooo 🎢 What to expect:

Knowledge-Level : 🟢 Beginner| 🟡 Advanced | 🔵 Expert

Market Update: Are we about to call the Fed's bluff? 🟡

Finance 2.0: Win Yourself a ticket 🥳

The dominant Swiss football club is in crypto…🟢

Media appearance: Blick TV 🟢

Insight DeFi on Social Media: LinkedIn / Instagram / Twitter / YouTube / Telegram

🟡 Market Update: Are we about to call the Fed's bluff?

written by Pascal Hügli

EExpectations were great – and the disillusionment just so? Last Wednesday was the Fed's press conference. In their FOMC meeting, it was announced that once again they would raise the federal funds rate by 0.25%.

In his hotly anticipated speech, Jerome Powell spoke of giving top priority to fighting inflation. Worries about a worsening banking crisis would have to take a back seat. The Fed Chairman also said that further interest rate hikes would probably not be appropriate in the coming months. At the same time, he emphasized: the Fed is not yet planning on cutting interest rates in 2023.

The market did not exactly know how to digest this information. After the press conference, the cryptocurrency fell in price. The question that many asked themselves: Is what was said by Fed officials now negative or rather positive for the markets?

Policy error in sight

Well, the market seems to be calling the Fed's bluff and believes that the central bank is on the cusp of committing a “policy error” by holding wrong assumptions about the economy and its financial situation. This is primarily reflected by a falling U.S. dollar. With the latest Fed decision, in aggregate, investors are now net short USD:

So, on the market side, there is the common belief emerging that the Fed will have to cut interest rates aggressively very soon to avoid something from irreversibly breaking in the financial world and the broader economy. Although the markets have calmed down somewhat in recent days due to what central banks have been doing, it seems that the banking crisis is not necessarily over yet.

For example, the CDS spreads of Deutsche Bank (DB), Barclays and Société Générale(SG) have widened again. These CDS spreads are an indicator of how much it costs for an institution to insure its credit default. If spreads rise, it is taken as an indication of increased default risk that the market assigns to a counterparty.

The CDS spreads of the three banks mentioned above are now wider again than they were on March 15 (a few days ago). This shows that the market is convinced that the risks are not yet off the table. A special focus should be on Deutsche Bank, which has been repeatedly mentioned in the past in connection with difficulties and is also likely to be intertwined with Credit Suisse.

Emergency lending is running hot again

The stress in the financial system can also be seen in the emergency facilities called upon by financial institutions. The most recent one is the Bank Term Facility Program (BTFP). This emergency program was launched only a few weeks ago – and already it is being actively used.

For example, the U.S. banking system's use of this new emergency lending facility increased by over $40 billion this week alone. BTFP loans currently stand at about $53.6 billion, up $11.9 from the previous week.

To be fair, primary credit, which banks can claim from the Federal Reserve through the stigmatized “discount window”, shrank by about $110 billion. However, the balance sheet of the Federal Reserve itself increased by about the same amount ($100 billion). Soberly, this means that slightly more than 60% of the so-called QT (quantitative tightening) carried out over the past years to reduce the US base money supply has now been reversed in just a few days. And the U.S. Federal Reserve balance sheet is only $200 billion away from new highs...

A hotly debated question is: Should the creation of base money and lending via BTFP loans be considered new money printing or not? Classic QE (quantitative easing), it is not. When the Fed engages in QE, it buys high-quality assets (government bonds or mortgage-backed securities) from banks as well as other institutions, adding new liquidity to the market.

The BTFP program works differently. Although banks provide government bonds as collateral to the Fed, financial institutions must pay high-interest rates on the loans (about 5%). Not only do the banks have to repay these loans, they also pay a fair amount of interest. Also, the credit money that the banks receive through the BTFP loan program is expected to remain as bank reserves on their balance sheets.

So it is the case that the increase in the Fed's balance sheet is not coming from direct purchases on the open market. It is “merely” the collateral that the Fed takes through giving out BTFP loans. So does this mean that Bitcoiners who are now again talking of relentless money printing are sounding false alarms?

Printing money, or not?

Yes and no. Things are more complicated, which doesn’t mean good. The U.S. Federal Reserve accepts government bonds at par through this BTFP emergency program. In concrete terms, this means that banks can deposit their government securities with the Fed as collateral for a loan. And even though the government security is currently trading at a 60% discount (this is an arbitrary number and just an example) to its former issuance price, the bank gets a loan at that higher issuance price.

This is a form of money supply expansion in the sense that the price deflation actually demanded via the market is offset. And that's where the effect is. The Fed is trying to reduce credit and duration risk by trying to prevent a reduction in the money supply. It’s kicking the cane down the road yet again…

So what is the bottom line here: What we are experiencing right now is not QE - it is the harbinger of it. It is the provision of emergency liquidity via credit. We already saw that in 2008. Even then, the emergency loans were followed by the actual QE, and that was done in several stages:

This is exactly what the markets are already anticipating today, as they are always forward-looking. Bitcoin, in particular, has made the strongest advance here (as an anticipatory liquidity barometer). Even if the big game and the big money glut have not yet returned, the signs are clear, and the US Federal Reserve has signaled that it will intervene if it has to.

Momentum seems to be back

In terms of bitcoin trading volume, the past week was quite something. Thus, the volume for bitcoin spot trading is said to have never been so high before. Also, others are convinced that the momentum has come back and, from a chart-technical point of view, the bulls on the Bitcoin market have taken over again.

Of course, it should be mentioned at this point that it is always dangerous to fall into euphoria too quickly – especially in the crypto market. Nevertheless, it should also be mentioned: If bitcoin leads a price rally after a long price bear market, historically this has also always been a sign of the beginning of a possible new bull market. And indeed, this is what we can conclude when looking at the data from the past few weeks:

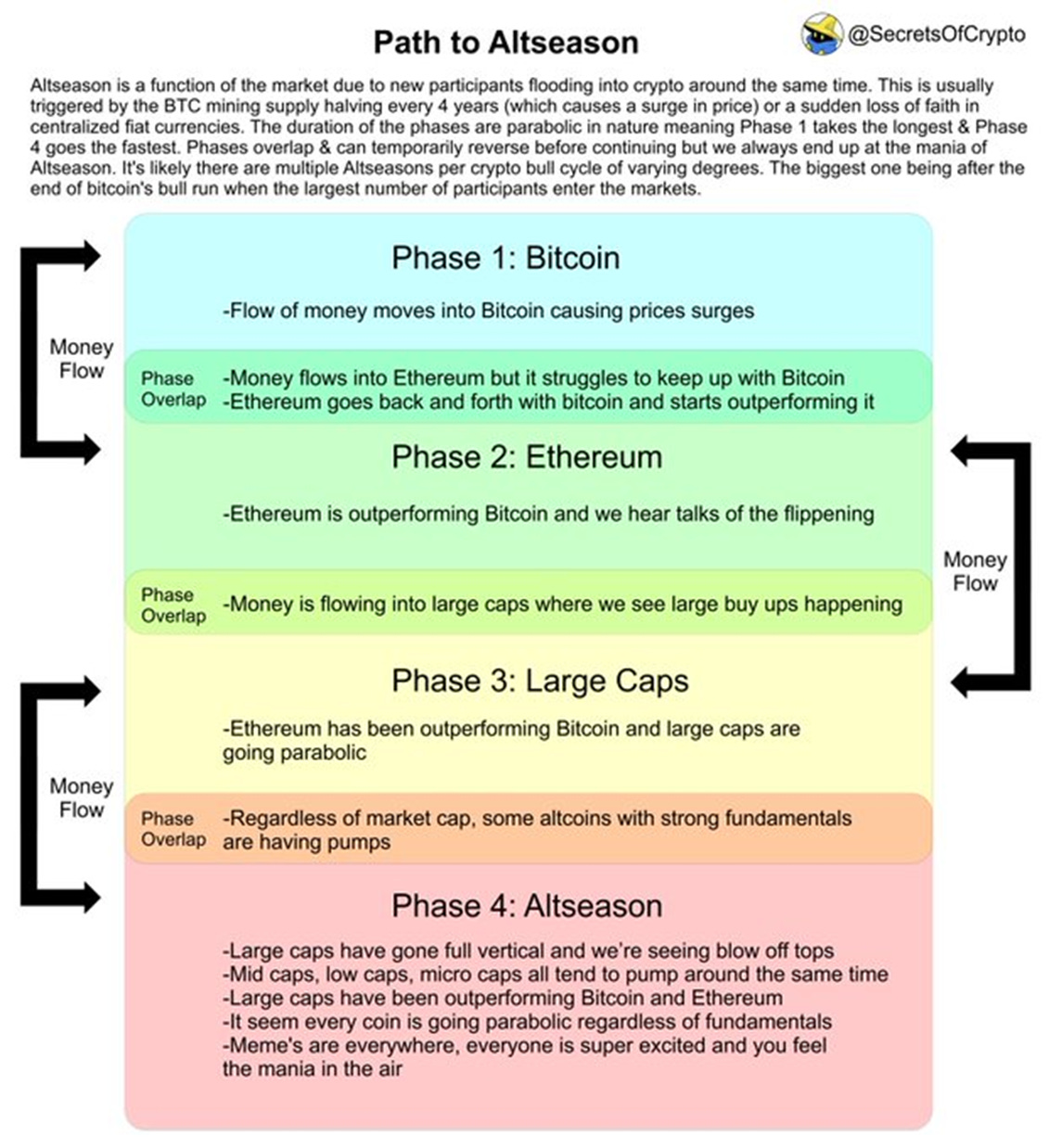

Bitcoin market dominance has resumed and altcoins, for the most part, have yet to catch up. Those who know how to play these phases and different stages somewhat correctly are certainly at an advantage. Here is an older, but still valid graph. If you study it today and learn to pay attention to the right parameters, you will be prepared for the inevitable future:

Arbitrum airdrop

For the time being, however, the big hype is not affecting the market as a whole, but the Arbitrum token is. This was distributed to various crypto users via airdrop on Thursday. It was probably one of the biggest airdrops ever in crypto history. The graph below also shows that. Transactions with the ARB token shot through the roof on the day of the airdrop:

So far, 77% of all tokens have already been claimed. All important airdrop live data can be found at Dune Analytics here. You can find out if you are one of the lucky recipients by following this link. There are still about 148 days left to claim your share. And of course ARB can be traded via decentralized exchanges like Uniswap and Co. or via CEXs like Binance. Interestingly, some are pointing out (with data) that whales are positioning for a move up with ARB. Also, there is a non-zero change that Arbitrum will end up being a top 10 project at some point.

But the airdrop is not the end of the story. Arbitrum already has a vibrant ecosystem, and this now offers other strategies. One is to take advantage of the current hype and farm ARB tokens. This Twitter thread here should provide information on what options are available to do that.

And besides farming, many believe that various Arbitrum-based token projects could also perform well in the coming days to weeks. Well-known projects that are still associated with Arbitrum are GMX, MAGIC or GRAIL. The following two Twitter threads name a few more exciting projects:

As always, the search for the “Hidden Gems” is not easy. But perhaps ChatGTP will soon help us in this regard. Alex Kruger asks the loaded question on Twitter, “How long until we can use ChatGTP to manage our trade book and farm airdrops?” On that note, we found the following “experiment” here fascinating. Someone asked ChatGTP about the next big token opportunity, letting the AI evaluate Twitter threads from crypto gigabrains...

Future Airdrops

For the time being, we at Insight DeFi are still proceeding manually though. Because after the airdrop is before the airdrop – the next windfall is potentially already calling. So there are still many more airdrops to come. Especially now that Arbitrium has rekindled the fire, more may soon follow. Here is a possible selection.

Of course, airdrop farming is akin to a full-time job, so you should focus on a few projects. As for Insight DeFi, we have Starknet and especially zkSync on our radar.

For example, just one day after the Arbitrum airdrop, zkSync drew attention with a Twitter post. What 3/24/2023 exactly means can only be speculated about. Maybe the snapshot date for the airdrop? We don't know. For those who believe that they have not yet missed their chances of participating in the zkSync airdrop that is due at some point, here are a few strategies to follow as well:

Finance 2.0: Win Yourself a ticket

Crypto is already making a real-world impact. And Switzerland is at the forefront of contributing. And YOU can be right in the middle of it all! In partnership with @Finance 2.0 we are giving away two tickets to our @Insight DeFi community for their upcoming “Crypto Assets 23” conference.

On the 29th of March 2023, from 13:00 to 18:45 the Finance 2.0 conference organized by @Rino Borini and team will be going down in Zuerich. Besides an interesting line-up of interesting speakers like Pascal Bruderer, Eliézer Ndinga, Désirée Velleuer, Mark Dambacher, Lucy Taylor, Dr. Stephan Zwahlen, Alexandra Janssen, and others, Switzerland’s first Swiss crypto awards will be awarded

To make yourself eligible and win 2 tickets for the Crypto Assets 23 conference hosted by Finance 2.0 go follow Insight DeFi and Finance 2.0, like or comment on this LinkedIn post, subscribe to your newsletter (ENG and DE, see below), and write us a quick hello message to pascal@insightdefi.com. Make sure to do this before Sunday, March 26th 23:59 local Swiss time.

Insight DeFi Newsletter (ENG):

Insight DeFi Newsletter (DE):

🟢 The dominant Swiss football club is in crypto…

written by Pascal Hügli

TFC Barcelona, Manchester City, Paris St-Germain or Juventus Turin, they all already have a fan token as well as many other football clubs in this world. In Switzerland, too, there is a club that is in the mix here. It is the Bernese sports club Young Boys.

Currently, there are just over 1,300,000 YBO tokens in circulation and according to FanMarketCap, the total supply of tokens is said to be 5 million. We at Insight DeFi spoke with Antonio Dragusin from YB's marketing department about the fan token, its purpose and the benefits of blockchain technology for football clubs.

BS Young Boys is one of the few football clubs that already have a fan token, right?

We issued the fan token in collaboration with the blockchain company, Socios.com, about 2.5 years ago. At that time, and still today, we are the only club in the DACH region that has gone down this path.

What is Socios.com, and what is the function of the fan token?

Socios.com is an innovative platform that gives soccer fans the opportunity to participate in votes and competitions for their favorite clubs. The prerequisite are so-called fan tokens, which can be purchased and traded in the app. These are based on blockchain technology. Important: these fan tokens are not a means of payment but offer voting rights.

What does this voting right consist of?

Already with one fan token, a fan is entitled to participate in all votes of a club. The fan tokens are not lost when participating in a vote and remain valid forever. Besides us, top European clubs such as Juventus Turin, FC Barcelona or Paris St. Germain are also active on Socios.com.

What rights and opportunities does the YB Fan Token give a token holder?

For example, token holders can choose the away jersey for the 2022/23 season. In this context, five fans were then invited at random for the marketing photo shoot of the away jersey. Another vote was for the captain's armband. The creator of the captain's armband was also invited to the stadium for an official handover. In other words, the fan was invited to join the training and was allowed to hand over the armband to Fabian Lustenberger (YB captain) before the start of the season. Here you can find a list of all the votes that have been made so far.

How many fan tokens do I need to participate in these polls?

With just one $YBO token, you have the right to help shape the club's decisions in exclusive polls. For each of these polls, there is a limit to the maximum number of tokens that can be used per fan. In addition, fan token holders are entitled to a diverse selection of rewards, from YB fan merchandise and VIP admissions to the Wankdorf stadium to “meet & greets” with players and much more. Important to note: All-Season Ticket holders and additional YB members are entitled to a free YB Fan Token ($YBO).

How does the fan token benefit the YB Football Club?

First and foremost, we are always interested in creating new added value for our fans and increasing engagement in the process. In addition, we want to continue positioning ourselves as an innovative company and strengthen our pioneering role in Swiss football. In terms of our strategy as well as operational goals, the partnership with Socios.com is an ideal fit. And the appearance as a first mover in the German-speaking region further reinforces these effects.

What couldn’t you do, or only to a limited extent, if there was no token?

Without blockchain technology, we would not be able to conduct tamper-proof and transparent voting. In addition, this token allows us to implement other use cases as part of your blockchain strategy. We are currently diving into the new world of Web3 with our NFTs and the fan token. What does that mean exactly? In the future, selected offers and products will only be accessible to holders of such digital products. To do this, you can connect to any digital wallet in our store.

What plans does YB have to develop the concept around its own fan token?

As mentioned before, we are trying to introduce the principle of “token gating”. This means that you can access certain products (analog or digital) only if you have connected your wallet holding a fan token via a regular website. We also want to integrate the Socios.com platform into our environment using an API. We don't want to have to direct our fans to a non-club platform anymore.

How is the fan token received by fans, and what is YB doing to promote awareness among fans?

With the annual 6 to 8 votes, we try to bring the digital product closer to the people. We also communicate the votes to our members via our newsletter. The product is particularly well received by digital-native fans. Of course, there are critical voices. We try to strike a balance here and incorporate the criticism constructively into the design of activities around the fan token.

Do you have a specific example in this regard?

For example, the issue of stakeholder management is very important to us. Listening to all stakeholders and responding to the needs of these groups in connection with the fan token is very essential to us. This also means that certain votes are discussed with our fan representatives in advance.

In addition to the fan token, YB is also using blockchain technology to launch NFTs. What does YB use NFTs for?

YB NFTs are digital collector cards of players from the 21/22 and 22/23 seasons. Here, we focus on the digital collection aspect that we want to enable for our fan. In addition, we have been able to launch a successful CSR campaign with the help of NFTs. In this way, we as YB are making a contribution to general sustainability and are therefore assuming our responsibility as a company in society.

What does this campaign consist of?

Together with the beekeepers' association BienenSchweiz, we have created a collection of a total of 3,000 NFTs that can be purchased via the BSC Young Boys online fan store. 100% of the net proceeds go to a project that promotes sustainable flowering areas for Swiss bees.

NFTs for bees – the YBees. Sounds fun!

That's exactly what we call these NFTs. The 3,000 NFTs are unique bees that were created in comic style and entitle the holder to different YB accessories depending on the trait. The YBees were created (minted) on the Flow blockchain, which is considered a sustainable blockchain. Depending on their rarity, the NFTs cost between 20 and 300 francs. The sale started on December 16, 2022, and many YBees already have their proud owners today.

What experience and knowledge has YB been gaining over the past few months in connection with these experiments?

At YB, we have built up a huge amount of know-how on the subject internally. Usually, football clubs do not deal with such topics. This also helps us to be strategically ahead of the competition. Although technology is not yet the decisive factor in the soccer industry, we are convinced that we are well-equipped for the coming future.

Are there points here that YB would do differently today in relation to this new technology?

We have learned that you have to be adaptable and that the direction of such a project can change very quickly. Accordingly, expectation management has to be taken seriously as such projects have to be adjusted more frequently and in a more agile way compared to other projects.

Is there anything else that has not been said?

In terms of content, everything has been said. We are always pleased when we can report on how we are dealing with future technologies at YB. We are happy to raffle off one of our YBees among Insight DeFi readers.

Let’s goooo and thank you very much! Whoever wants to win a YBees, send us an email at pascal@insightdefi.com and tell us why you want to win.

🟢 Media appearance: Blick TV

written by Pascal Hügli

This week, we were asked by various media sources for our opinion on the Bitcoin price increase in the context of the banking panic. Besides a short TV appearance (Swiss-German), Pascal Hügli was also quoted by various media outlets (FuW, Nau, Watson, and more).

What we at Insight DeFi think about the whole thing is briefly and succinctly summarized in the lines below.

Is Bitcoin now the new Swiss bank account?

The worsening banking crisis is keeping the world on its toes. In the US, the Federal Reserve faces a dilemma: In order not to gamble away its trust, it must continue to fight inflation. If the central bank raises interest rates further, it risks worsening the precarious situation of ailing regional banks.

In Switzerland, Credit Suisse had to be forcibly merged with UBS – all with the active support of the Swiss National Bank. Both banks are given unrestricted access to the facilities of the Swiss National Bank. So the UBS takeover is in fact a bailout sponsored by the Swiss central bank.

Tower of Babel – made in Switzerland

This forced marriage – the merger of two systemically important banks – will create an even larger complex that will eventually exceed the power of today's god-playing central banks. Since the problems have only been suppressed, not solved, a repeated bailout in the future is likely to be inevitable – but it is unclear whether this can then still be managed.

For many, however, such an issue is a thing of the future. After us, the deluge. But what the situation brings to our attention in the here and now is this: More and more people are just becoming aware that a bank deposit is an unsecured loan tied to a counterparty. From one day to the next, the search for alternatives is once again on – as it was at the beginning of the 2008 financial crisis.

At that time, there was no bitcoin. The latter has no counterparty risk and can be held independently and self-sovereignly. But the digital crypto asset was only created as a possible answer in the wake of the last financial crisis. As the past few days have shown, the narrative of Bitcoin as an alternative seems to be catching on.

Banking crisis causes Bitcoin to rise

For example, since the initial turmoil surrounding the Silicon Valley bank just over a week ago, the crypto asset has risen in value by over 30% against the US dollar. Gold has seen a price increase of about 6% over a similar time frame, while the Swiss franc has weakened against the U.S. dollar. Bitcoin as an escape currency, then?

However, the real reason is likely to lie elsewhere at this point in time. Thus, it can be assumed: Bitcoin's strong rise in this short term is mainly due to Bitcoin investors anticipating the end of the current interest rate upward cycle due to the imbalances in the financial system. In the medium to long term, current events should increasingly legitimize bitcoin investing. People will want alternatives and in a digital world there will be no getting around Bitcoin. Thus, this trend can already be seen in the first inquiries from family offices and asset managers that reach us these days.