Applecalypse and the BlackRock fever

Will China be the new USA?, Different than expected, Escalation in the crypto war, The Lightning Network vs. Apple, VC on Web3 investments, view of the cautious investor

Let’s gooo 🎢 What to expect:

Knowledge-Level : 🟢 Beginner| 🟡 Advanced | 🔵 Expert

Liquidity Corner: Different than expected - and yet somehow expected 🟢

How investors are surfing the next Web3 infrastructure wave 🟢

On the crux of the crypto world: the view of the cautious investor 🟡

Insight DeFi on Social Media: LinkedIn / Instagram / Twitter / YouTube / Telegram

🟢 Market Update: Will China be the new USA?

written by Pascal Hügli

In macro terms, things are not looking so bad. In particular, the latest inflation figures of 4% were slightly better than the expected 4.1%. There are also signs that the inflation cycle is definitely coming to an end. Of course, there are critical voices, who assume that we will have to accept structurally higher inflation rates due to deglobalizing effects.

Whether this is the case remains to be seen at present. In the short term, inflation will probably continue to fall and, according to the Truflation indicator, reach the 2% mark in the USA in a few months (remember: the official figures have a lag of 2-3 months).

Accordingly, the U.S. Federal Reserve left interest rates at the current level of 5 to 5.25 basis points at its last meeting. The notorious pause in interest rates has therefore occurred. How long this will last ultimately depends on future inflation figures. The Fed Chairman has announced that the “terminal rate”, i.e., the upper end of the yield curve, could well be revised higher – to 5.6% as opposed to 5.1% as before. The market currently expects a probability of over 70% that interest rates could be raised again at the July meeting.

As far as financial liquidity in the system is concerned, we go into more detail in our current Liquidity Corner. This much in advance: the liquidity situation is currently better than expected. Nevertheless, cryptoassets have come under pressure in terms of price. On the one hand, expectations that financial liquidity will deteriorate have probably had their effect. On the other hand, the crypto world is currently just once more being hit by a shock wave inherent to the market. First and foremost, the allegations made by the US Securities and Exchange Commission (SEC) against Binance and Coinbase had it all.

We provide a detailed analysis of the accusations and what they mean for the market and market participants in our guest article “Escalation in the Crypto War: What You Need to Know”. What we would like to point out at this point: The current situation not only resembles an attack by the SEC on the two largest crypto exchanges, it is also likely to turn out to be a war between West and East.

From Exodus to Diaspora?

While the United States has launched its major initiative against crypto, the crypto situation in various other jurisdictions is developing rather positively. In Europe, where we are still closest to the United States, the MiCA framework was recently signed. In the UK, the aim is to become a crypto hub, while Dubai has been pursuing this goal for some time. And in Russia, the largest bank, Sberbank, has recently started offering crypto trading.

But the most impressive development is in Asia. Just two years ago, China banned Bitcoin mining and thus led to a large exodus of the same. Today, it is mainly Hong Kong, which many consider a Chinese protectorate, that is extremely bullish towards crypto. It is particularly exciting that Hong Kong has officially released various cryptos for trading, which the SEC has assessed as securities. If that doesn't give you a fighting chance.

Thus, Hong Kong lawmakers have invited Coinbase to become operational in the region. The fact that Hong Kong is serious is also evident from the fact that they are pushing various banks to onboard crypto customers faster. Last but not least, it was announced that the Bank of China has started issuing securities on the Ethereum blockchain.

So, as it turns out, Asia around Hong Kong could become more important for crypto again in the short to medium term. That would also mean looking more to Asia again in terms of liquidity flows, which are after all crucial for crypto prices, as they could lead the liquidity cycle in the foreseeable future. For the bulls, that would probably be music to their ears, after all, it was just announced that China wants to boost its economy again with a financial stimulus package.

More news

BlackRock and the “Bitcoin-ETF”

The probably biggest asset manager in the world with an estimated $10 trillion, Blackrock is supposed to launch a Bitcoin-ETF according to the media. This news has been circulating through the online gazettes for a few days. In times of uncertainty and FUD (Fear, Uncertainty, and Doubt), such news is of course balm for the crypto soul.

Only, and this is the “catch”, the product mentioned is not supposed to be an actual ETF at all. If you read the announcement carefully, you will learn that it is supposed to be an open ended trust. Consequently, this should mean that this BlackRock product, should it come to the market, will have the same, arguably less severe, “problems” of a discount or premium to the intrinsic value as the well-known Grayscale Bitcoin Trust, which played a significant role especially in the bull market of 2021.

So even if the media and the many copycats on Twitter don't take it too seriously, the relevance of BlackRock and the fact that the global asset manager is considering such a product cannot be understated. After all, this is a real blue whale, to use crypto-speak:

Tether has its Depeg moment

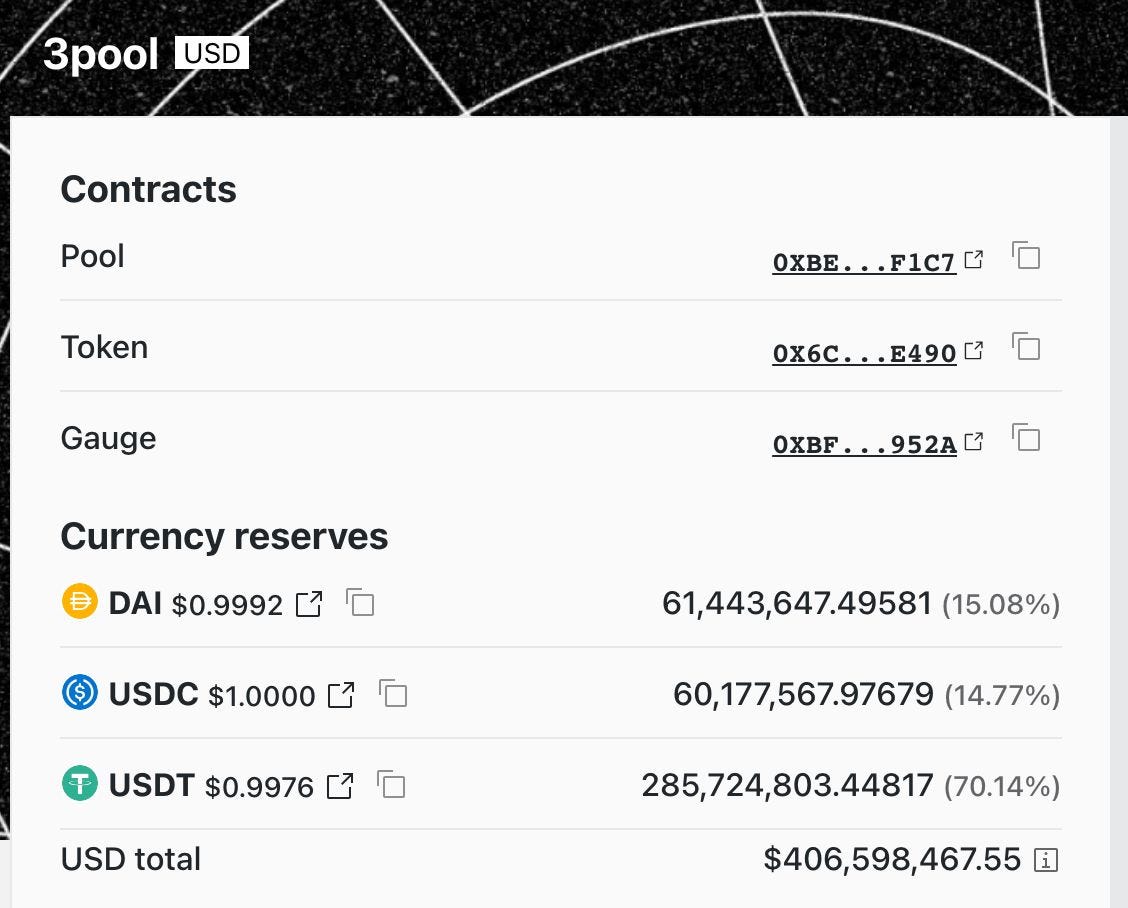

"Every year," you might say. Yes, every year a stablecoin loses its 1-to-1 exchange rate to the underlying fiat currency in the short term (for some stablecoins the short term then turns out to be permanent...). Currently, it is crypto's largest stablecoin USDT whose price has fallen below $1.

The reason was that two DeF protocols in particular (Uniswap and Curve) were flooded with USDT sellers. Why such a large number of sellers of Tether came on the scene is unclear at this time. Some speculate it is because CoinDesk has reportedly received Tether’s financial documents from the NY Attorney General’s Office.

Is it once again the infamous Tether FUD, or is there more to it this time? 3Pool’s imbalance, because USDT is aggressively sold into the market, also happened when FTX collapsed and the Terra ecosystem’s crashed. Some think that his could be a warning sign of what is to come.

The next few days will show. In any case, those who want to protect themselves against the recurring stablecoin de-peggins in the future can do so directly via the blockchain. The Y2K Finance project offers this possibility.

For example, there is the product "Earthquake" here, which allows users to buy (or sell) depeg insurance for various crypto assets. Among them are stablecoins as well. A good overview can be found here. However, it should also be said: Before you rush head over heels into this product, it is always important to do your own research (DYOR - Do Your Own Research, as they say). After all, it does not help if you protect yourself against one risk only to be exposed to other, potentially greater risks (such as protocol risks of Y2K Finance, for example).

Brief overview

Uniswap V4 goes live. A good summary can be found here.

Also live is the much anticipated EigenLayer protocol. A good overview of the most important facts can be found here.

And by the way, don't forget: Now that the headlines are again such as below, it is especially worthwhile to stay tuned to crypto:

🟢 Liquidity Corner: Different than expected - and yet somehow expected

written by Pascal Hügli

A look at the numbers:

Net financial liquidity in the U.S. (with the BTFP emergency lending program):

June 01 (past newsletter issue): $6,206 billion

June 15 (current newsletter issue): $6,264 billion

️↗️Increase of $58 billion.

Broken down even further here:

Total balance sheet* of the Federal Reserve:

June 01 (past newsletter issue): $8,385 billion

June 14 (current newsletter issue): $8,388 billion

️↗️Increase of $3 billion

Reverse repo programs in the USA:

June 01 (past newsletter issue): $2,160 billion

June 15 (current newsletter issue): $1,992 billion

↙️Reduction of $168 billion

U.S. Treasury General Account (The U.S. government's "bank account" at the Federal Reserve):

June 01 (past newsletter issue): $23 billion

June 15 (current newsletter issue): $133 billion

↗️️Increase of $110 billion.

Contrary to general expectations, net financial liquidity has increased over the past two weeks, and this despite the fact that the U.S. debt ceiling has been raised and the Treasury has begun borrowing ($296 billion, to be exact).

As the numbers show us, the U.S. government's bank account (TGA) is filling up again. But the reason this has so far had a rather neutral (even slightly positive) effect on the financial liquidity in the system is as follows: The money is flowing out of the so-called reverse repo programs - the figures also show us this clearly. Graphically, it then looks like this:

So far, the U.S. Treasury has been seen as raising money primarily from the short end of the yield curve by issuing short-term debt securities. If the Treasury issues mainly short-term bills and the money for U.S. debt comes from the reverse repo facility (“idle” money parked at the Federal Reserve), the impact on liquidity is neutral. This is exactly the effect we can observe so far.

If the U.S. government continues to focus on short-term debt issuance – and that seems to be the goal at the moment – this should be negative for reverse repos, neutral for bank reserves, and positive for bank deposits. All in all, net financial liquidity in the system would then not be as impaired as many expected weeks ago. In general, some point to the past, where the issuance of U.S. government securities has triggered an upward trend in the liquidity cycle in each case:

🟢 Escalation in the crypto war: what you need to know

written by Merens Derungs

The preliminary climax of the crypto war culminates in the US Securities and Exchange Commission (SEC) filing a lawsuit against the world's two most important crypto exchanges, Binance and Coinbase, within two days. But what exactly are the two crypto exchanges accused of? Are your tokens safe? And what does this mean for the crypto industry? Find out more in this post.

What is the SEC accusing Coinbase of?

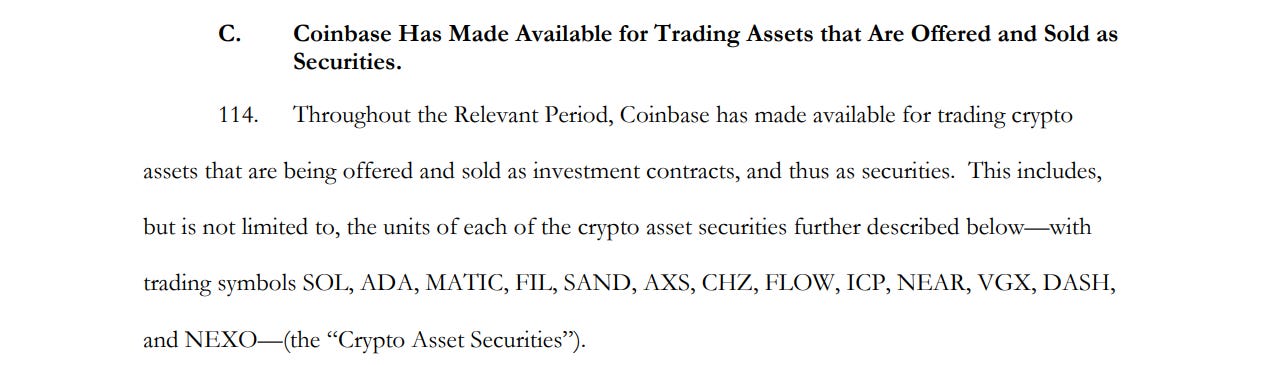

On June 6, the SEC filed a lawsuit against Coinbase in New York (see lawsuit). The lawsuit targets the core of Coinbase's business model, which is token trading. The SEC considers most tokens to be securities, which is why special licenses are required to sell and trade them. However, Coinbase does not have these licenses and thus operates a non-registered securities exchange according to the SEC.

The complaint contains a list of tokens that are securities according to the SEC. Among them are big names such as Solana (SOL), Cardano (ADA) or NEAR, all projects based in Switzerland. Ether, on the other hand, is not listed. Coinbase's staking offer is also considered illegal by the SEC.

Binance – the next FTX?

On June 5, the SEC filed a complaint against Binance, with allegations far worse than those against Coinbase (see complaint). The SEC first accuses Binance of the same thing as Coinbase, namely operating a non-registered securities exchange. In addition, the SEC raises several other allegations against Binance related to Binance's nested corporate structure (cf. Fig. 2).

Binance has always been criticized for its opaque structure and frequent seat changes. Now, however, it appears that Binance has effectively abused this structure. According to the lawsuit, Binance transferred billions in assets without any oversight to two companies that CZ personally owned. These two companies, Sigma Chain AG and Merit Peak Ltd (see Figure 2), are alleged to have subsequently traded these funds on Binance. That these are not frivolous allegations is shown by the FTX case, where such transactions between FTX and Alameda led to the bankruptcy of FTX and customers lost billions of assets.

Assessment of the lawsuits

The SEC has brought up heavy artillery against the world's two largest crypto exchanges. The lawsuits have been extremely carefully prepared and are well researched. The allegations against Binance are serious and, if true, alarming for any customer. Binance has a similar structure to FTX, whose demise has massively damaged the crypto industry. By the SEC pre-emptively intervening here against a suspected bad actor, the crypto industry will be done a favor in the long run.

A different scenario arises for Coinbase. The allegations against the company relate exclusively to the sale and trading of tokens. That is, the only thing the SEC believes Coinbase did wrong is the sale of tokens. Therefore, Coinbase cannot be considered a Bad Actor at all. If the lawsuit is decided in favor of the SEC, the result would be that crypto exchanges would be de facto banned. This is tantamount to a general attack on the crypto industry.

You can find more details about the two lawsuits in our Youtube video:

Where do we go from here?

Now that the lawsuits have been filed, Binance and Coinbase have the opportunity to take a stand. For Binance, the only issue for now is whether the assets of the U.S. company will be frozen. Binance has already submitted a statement on this and a first hearing has taken place (see Binance statement). Both crypto exchanges have already announced that they will defend themselves rigorously. The lawsuits could take years and will probably not be decided until the highest court in the US, the Supreme Court.

For Coinbase, an affirmation of the lawsuit would likely be the end of the company. Coinbase generates the majority of its revenue in the U.S. (see Fig. 3). No figures are available for Binance, although an affirmation of the lawsuit would probably lead to the discontinuation of the American company Binance.US. Furthermore, an affirmation of the lawsuit would probably be the end of the US crypto industry. All activities with tokens would be effectively banned in the US - from buying and trading tokens to staking and stablecoins. The beneficiaries would be Asia and (hopefully) Europe.

What are the implications for you - are your tokens safe?

There is understandably a lot of uncertainty among investors at the moment as to whether their tokens are still safe. It has already been leaked that Binance.US accounts may be blocked by the SEC. What should you do now?

First of all, the lawsuits do not indicate that customers have already been harmed (unlike FTX). It's about preventing future harm. So if you are a customer of one of these two platforms, nothing will change for you for the time being. Nevertheless, the lawsuits show that central players in the crypto sector pose a threat to you as an investor. The easiest way to protect yourself is to store your tokens yourself. Because: Not your keys, not your coins.

If you still want to use a central intermediary, you are well advised to choose an intermediary based in Switzerland or at least in the EU. You can easily find out the location of the intermediary in the imprint of the website. A Swiss intermediary is subject to the Swiss Financial Market Supervisory Authority, which should prevent a case like FTX. The past shows that Swiss regulation is relatively good: several large crypto exchanges have already considered moving their headquarters to Switzerland, but then decided otherwise because the regulation was too strong. Some of these crypto exchanges no longer exist.

About the author:

Merens Derungs is a capital markets lawyer by profession, having helped large companies raise capital on the stock market. It was only as a PhD student that he (involuntarily) came into contact with DeFi and thus realized its potential. Since completing his dissertation on the topic of the digital stock, he has been obsessed with the idea of building the first public marketplace for startups as Co-Founder of Arcton (www.arcton.com). Currently, he is looking for beta testers for the new platform, if you are interested you can reach him on LinkedIn. He also runs the YouTube channel https://www.youtube.com/@ArctonHQ.

🟢 The Lightning Network vs. Apple

written by Joel Kai Lenz

The last 72 hours have been intensive for the team behind Damus, a popular nostr client on iOS. Out of the blue, Apple contacted them and warned that they have 14 days left in the App Store if they don’t remove certain features in their app.

In case you didn’t know, nostr, short for Notes and Other Stuff Transmitted by Relays, has gained popularity amongst the Bitcoin community. Ever since Jack Dorsey publicly announced that he’d be donating and supporting the cause, the protocol has seen a mass influx of new users.

These users can use the protocol in a number of different ways, from clients like Damus, which are more similar to a Twitter experience, to solutions like NostrChat, which is similar to a chat application like Telegram.

Apple Doesn’t Like the Lightning Network

All of these applications allow users to engage with the nostr protocol and exchange notes and messages but also tips. These tips are called Zaps and are sent over the Lightning Network. The idea behind them is to attach a financial incentive to content.

If someone posts a great post, others should be able to reward them instantly and exchange value for value. We already see similar possibilities with Podcasting 2.0, where listeners can send Lightning tips to their favorite shows.

Ultimately, Zaps were the issue why Apple blocked and threatened Damus. They requested to turn off Zaps under each post and only allow them on profiles. Inevitably, Apple used its monopoly over the App Store to tell Damus what they needed to change with their app. The project’s app would be banned and removed from the App Store if they didn’t cooperate.

This wasn’t the first time Apple blocked a Bitcoin-specific app. We saw the same thing last year with Relai and other Bitcoin wallets in the past. From the looks of it, Apple doesn’t seem to be a Bitcoin-friendly partner and is either enforcing stricter rules to keep their App Store safe from malicious actors or acting as a pioneer for strict regulation.

What Are the Alternatives?

The issue with the current removal by Apple proves how much influence these App Stores and Big Tech companies have over small companies or app developers. With Android, users at least have the opportunity to download APKs and bypass the App Store.

At the moment of writing, we don’t see this option yet for Apple users. However, the EU has announced a potential bill that would force Apple to offer similar APK solutions to users in Europe.

Another option for developers is to build web-based applications, which would enable less attack surface for App Stores and still allow users to use the apps on their mobile devices, either by visiting the website on their phones or saving a shortcut to the website on their home screen. Mash or Mutiny, both Lightning wallets, did just that with their most current update.

The other option developers have for now is to wait and see how far Apple is pushing the needle. This issue could be a thing of the past with upcoming regulations and new bills to protect users from the monopoly of these Big Tech companies.

If there is one thing I’ve learned in the past, Bitcoin companies and developers are incredibly adaptable. Chances are, most of them are already thinking of solutions and will release them very soon. For Damus, the answer was to give in, for now, and only allow Zaps on profiles. But it seems the last word has not been spoken…

🟢 How investors are surfing the next Web3 infrastructure wave

written by Mathieu Chanson

The value of blockchains and Web3 startups has grown rapidly in cycles over the past few years. Over the last three years, an average of over 300,000 addresses were active on Ethereum every day. In 2022, $7 trillion was settled through stablecoins (cryptocurrencies representing the U.S. dollar), more than through Mastercard (2.2 trillion).

This chart shows the total USDT and USDC volume settled per year.

Source: Cryptoslate

Blockchains are not only used for the simple exchange of money, but also for complex financial applications, from financial marketplaces to loans and options. The special feature of such financial applications on blockchains is their decentralized structure, which is why they are also referred to as Decentralized Finance (DeFi). Currently, there are deposits of over 50 billion in DeFi applications. Non-Fungible Tokens (NFTs), which can represent digital collectibles, art, or media such as music, also continue to see brisk use. In 2022, over $24 billion worth of NFTs were sold.

The need for better infrastructure

Although blockchains are now being used extensively for various use cases, further major advances in infrastructure are needed to make Web3 accessible to the global mass market. In particular, the following two issues are significant barriers that need to be overcome:

Transaction costs and speed: Most users are not willing to pay several US dollars for each transaction. Solutions to this are being built right now by various teams, for example so-called layer-2 protocols such as Arbitrum, Optimism or zkSync.

Ease of use: Interacting with blockchains is still extremely difficult. Here, too, there are various solutions in development, such as Argent and Capsule.

However, blockchains (Layer 1s or Layer 2s) alone are not enough. Web3 needs additional infrastructure to become usable for a broader range of applications. Startups are currently tinkering with so-called “middleware” protocols that add data, computation, identity, and credentials to blockchains (e.g., Eigenlayer, Capsule, AlloyX). All of this is necessary for a robust and efficient foundation upon which broader Web3 applications can flourish. The relationship between applications and infrastructure is cyclical and interactive. Infrastructure is needed to enable applications, while applications attract new users and extend the demands on existing infrastructure.

Countless brilliant founders are working on this next wave of Web3 infrastructure, and we are confident that the above limitations will be solved in the next few years.

The comparison with the Internet

Internet versus Web3: Where are we in terms of adoption?

Compared to the Internet, we are still in the early nineties. Currently, Web3 has only several hundred million users and the biggest growth to billions of users is yet to come. At the core of Web3 is the ability to separate money and government. It will create a new global monetary system that crosses borders and in which everyone can participate. The potential of blockchain and Web3 goes beyond financial applications. The Internet itself could be reshaped. Users are at the center of Web3 and can take back control of their data, their privacy, and their digital lives....

At very early Ventures, a Web3 VC from Switzerland, we are excited about this vision of helping to build a digital, global financial system and a fairer Internet. We can't wait to see what the future holds for Web3.

About the author:

Mathieu Chanson is Co-Founder of very early Ventures, a Web3 VC Fund investing early-stage Web3 startups, with a focus on tech infrastructure projects. Mathieu has experience as a product manager at Web3 startups Celo and MakerDAO and a PhD in Distributed Systems from ETH Zurich.

🟡 On the crux of the crypto world: the view of the cautious investor

written by Pascal Hügli

Among investors, the topic of "AI" is all the rage right now. It seems that the hype around ChatGPT, Bard and similar technologies has successfully replaced the previous big narrative around cryptoassets and blockchain technology this year.

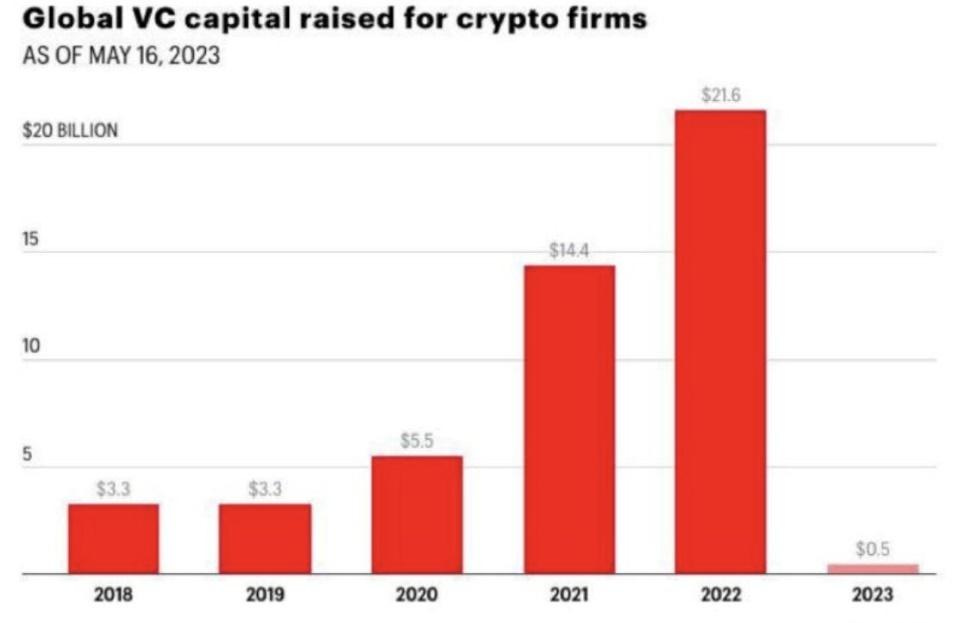

As recently as 2021, during the height of the previous crypto boom, it was crypto VCs that dominated the headlines, investing a record $33 billion in crypto/blockchain/Web3 projects and startups. Currently, the euphoria about crypto among private investors has cooled down noticeably, but various blockchain projects, especially so-called Layer 1 solutions that develop blockchain base platforms, were able to raise astronomically high sums during the ongoing bear market.

One example is the Sui blockchain project, which was driven by former Meta employees (formerly the stablecoin project of “Facebook”) and raised a total of $336 million in two rounds of funding. Another project called Aptos, also kicked off by former Meta employees, raised a total of $350 million in VC funding. And blockchain project Worldcoin, co-founded by Sam Altman, CEO of OpenAI, recently made it to $115 million as well.

Friend or foe?

Given such current funding success stories of various crypto projects, some private investors feel reassured, as the interest of VC professionals would show that the crypto world is still facing a bright future. However, this conclusion turns out to be less clear-cut than it first appears.

After all, crypto venture capitalists are not necessarily the friends of private investors. This fact was recently pointed out in detail by the founder and chief scientist of Dfinity in a blockchain panel, which the author of these lines was allowed to attend. At the time, the project had

also raised over $100 million from numerous well-known VCs for its “Internet computer” idea.

The Dfinity founder's vote was scathing: From his hundreds of conversations with crypto VCs from around the world, he could tell that there are hardly any that have the overall interest of the industry at heart. Far too often, the largest venture capitalists invest in blockchains only to fund ecosystem applications that are largely dependent on centralized components and have little to do with the very idea of a blockchain. In doing so, however, they are turning a flywheel that will sooner or later come to a standstill, as all those involved simply lack a long-term perspective.

A world of perverted incentives

How should we classify the Dfinity founder's statements? Well, the market crash in 2022 and the related “collapse” of hedge funds and crypto VCs like Three Arrows Capital seems to confirm the short-termism of these players. The fall of the second-largest crypto exchange FTX in November last year also raises doubts about how clever and smart the so-called smart money really is, as few of the investors invested and closely associated with the exchange realized the scam.

It seems that crypto VCs have been particularly badly incentivized. In particular, the concept of tokens has led to a fundamental shift in interests. While traditional VC deals involve years of illiquid equity stakes, tokens are often made tradable much more quickly. To put it somewhat hyperbolically, tokens allow investors to profit from fundraising immediately. Financial reward - even for VCs - is less dependent on business performance. It depends even more on pushing coherent, enticing narratives about future success and business outcomes.

Because of these misaligned incentives, investors are becoming more speculative than ever, aiming to liquidate their position at the optimal time. In doing so, users are attracted in no small part by the introduction of a token.

Crypto as the spawn of the low interest rate decade

The token dilemma is also a problem peculiar to the crypto industry. The fact that so much money is flowing into risky investments such as cryptoassets is ultimately also largely due to the low to negative interest rates of recent years. This pressure for yield has led investors in all investment classes to increasingly invest along the risk curve in potentially more profitable, but also riskier, opportunities.

As a result of these dynamics, not only has investment risk increased for individual investors, but the overall economic risk of inadequate capital allocation has also increased. Low or even negative interest rates are tempting capital investors to inject cheap money into speculative ventures in order to generate a nominally high enough return to offset the real inflationary damage.

That the crypto world is highly subject to misguided incentives and a particularly strong misallocation of capital is blamed on it from its “own” ranks. The representatives, who see themselves as Bitcoin purists and do not want to be seen as part of the crypto industry, view crypto as an opportunistic result of more than 14 years of free money since 2008.

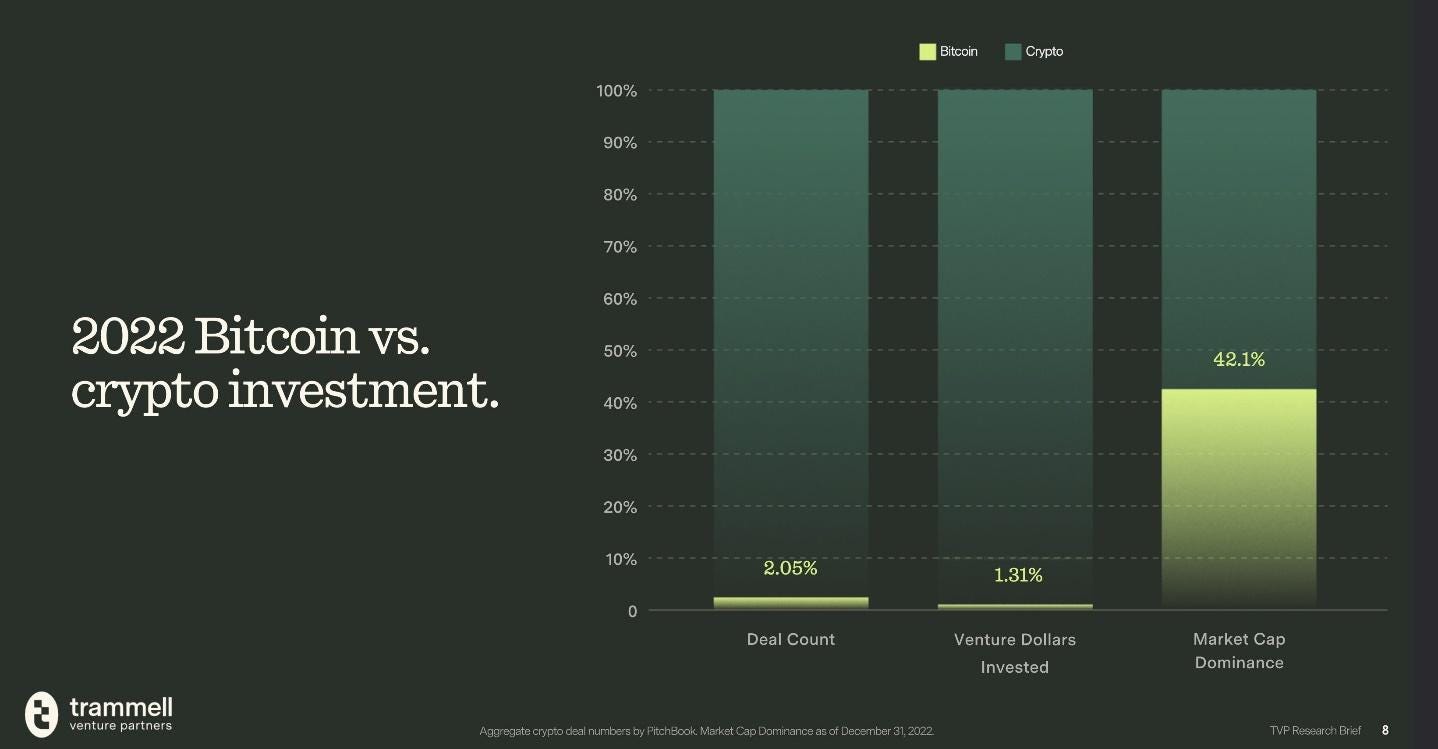

They are supported by analyses recently published by Trammell Venture Partners, a venture capital firm from Texas in the USA. Although the VC firm pursues a Bitcoin-only investment approach, the published findings are nevertheless interesting. For example, in 2022, the US dollar amount invested in Bitcoin projects accounts for just 1.31% of all investments made in the crypto market. Especially since Bitcoin is currently still well over 40% in terms of market capitalization, quite a few Bitcoiners believe they can read the above-described circumstance of capital misallocation from these figures.

Don’t be overdiversified

Do we agree with the Bitcoin-only representatives in their arguments? Yes and no. The incentives created by token constructs do indeed have their negatives. And the reality of a certain misallocation of capital that has piled up at VCs due to a prolonged period of zero interest rates and is now still being made available en masse by them in new hype cycles is also hard to deny – especially considering that there is little to no real innovation among the profiting Layer 1 blockchain projects.

Where the Bitcoiners disagree, on the other hand, is this: Not every crypto project is mere snake oil. Thus, it would probably be presumptuous to the point of presumption to want to claim today with absolute certainty that the innovation of distributed computing is really only likely to catch on in the form of the Bitcoin blockchain.

For a crypto investor, it is important to take both insights to heart – especially if he is invested for the long term. In concrete terms, this means that it is not necessary to chase after every crypto token, especially not every shiny new Layer 1 blockchain token and its ecosystem token. Rather, one should reduce one's portfolio to a few projects, of which Bitcoin should still be a significant part. In addition, one can diversify into a few alternative projects. In the long term, these should not only be able to serve a specific use case due to a certain unique selling proposition, but also be solidly positioned in terms of token distribution. This is the only way to minimize the risk of being bled dry by and through the VCs' intrigues, despite a technologically exciting approach.

Where have the big VCs of the crypto world made money with? The Twitter thread below provides an overview: