Blackrock let's rock

Video Market Update Juni, Liquidity Corner: U.S. and China hold the balance, Truth about Bitcoin - Ponzi or Ponzi scheme, Liquid Staking Derivatives, Race for the Bitcoin ETF & Meme Section

Let’s gooo 🎢 What to expect:

Knowledge-Level : 🟢 Beginner| 🟡 Advanced | 🔵 Expert

Insight DeFi on Social Media: LinkedIn / Instagram / Twitter / YouTube / Telegram

🟢 Video Market Update Juni

recorded by Pascal Hügli

In this market update we look at the current macro situation, assess the Bitcoin ETF news, why GLD Trust (Gold ETF) might not serve as a good comparison, look at potential Celsius sell pressure for some altcoins, talk about real companies adopting Bitcoin-backed stablecoins and look at the hottest narratives in crypto.

🟢 Liquidity Corner: U.S. and China hold the balance - for now

written by Pascal Hügli

A look at the numbers:

Net financial liquidity in the U.S. (with the BTFP emergency lending program).

June 16 (past newsletter issue): $6,084 billion

June 29 (current newsletter issue): $5,989 billion

↙️Reduction of $95 billion

Broken down even further here:

Total balance* of the Federal Reserve:

June 14 (past newsletter issue): $8,388 billion

June 28 (current newsletter issue): $8,340 billion

↙️Reduction $48 billion

Reverse repo programs in the U.S.

June 16 (past newsletter issue): $2,012 billion

June 29 (current newsletter issue): $1,935 billion

↙️Reduction of $77 billion

U.S. Treasury General Account (The U.S. government's “bank account” at the Federal Reserve).

June 16 (past newsletter issue): $267 billion

June 29 (current newsletter issue): $438 billion

↗️️Increase of $171 billion.

As the numbers show, net financial liquidity in the U.S. has declined by $95 billion over the past two weeks. This is mainly due to the reduction in the central bank balance sheet and the replenishment of the U.S. government's bank account (TGA).

At the same time, however, emergency lending to banks rebounded last week and funding of the TGA is occurring primarily through outflows from the reverse repo facility.

So as far as the U.S. is concerned, the liquidity trend is actually negative. Why then has bitcoin hardly reacted (or even reacted positively) to this so far? For one thing, the ETF narrative is certainly in full swing (see article “Race for the Bitcoin ETF”). For another, it is China that is currently expected to compensate for the liquidity situation. Thus, the Middle Kingdom has announced that they want to further boost economic demand. The Chinese side has also just lowered interest rates again.

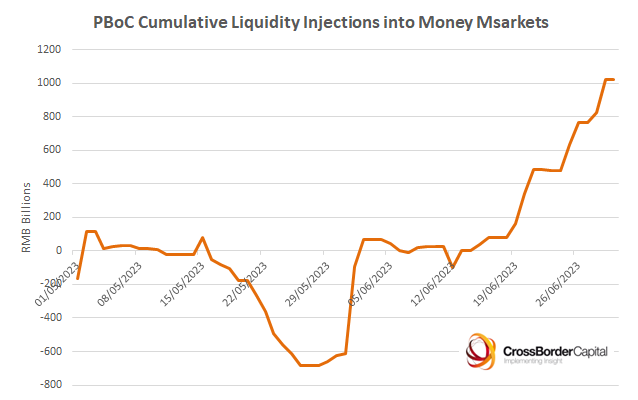

And the Chinese central bank is also supporting financial participants with liquidity injections via repo injections. Just two weeks ago, these stood at 42 billion yuan. Currently, we stand at 193 billion yuan, which means a net total of 151 billion yuan in additional liquidity. There is speculation that the reason for these interventions may also be the weakening Chinese currency against the U.S. dollar.

🟢 Ponzi or Ponzi scheme – the truth about Bitcoin!

written by Matthias Reder

Bitcoin has been live since January 3, 2009 and has enjoyed growing popularity from year to year. Yet, persistent misinformation about the mother of all cryptocurrencies persists. One particularly common claim is that Bitcoin is a Ponzi or Ponzi scheme. In this article, I clear up this misrepresentation and bring forth reasons why Bitcoin cannot be a Ponzi or Ponzi scheme.

Without money – no music

Let's start with a thought experiment: imagine that all trading venues for exchanging fiat money into Bitcoin and vice versa were closed. Even in this scenario, the Bitcoin network would continue to function as long as there are people providing power/internet, storage, and computing power to the network. Any Ponzi or Ponzi scheme collapses without fresh money. Fittingly, in 2022, I was asked by an employee of the Austrian National Bank, “Why are so many people working on Bitcoin? They don't get anything out of it!” To which I replied, “Nothing is stronger than an idea whose time has come!” (Victor Hugo).

The power of open source

The idea of Bitcoin was first communicated on October 31, 2008, World Savings Day, on the website www.bitcoin.org. Anyone could have picked up the idea at the time and adapted it for their own use. Unlike common Ponzi or Ponzi schemes that carefully hide their operations and organization, Bitcoin is completely transparent. The network has been live since January 3, 2009 and was regularly improved with updates in the early days. Everything is open source and can be viewed 24/7. It is undeniable that an idea like Bitcoin would not get so much time to develop nowadays.

Fixed amount of available units

The anonymous founder Satoshi Nakamoto is said to own over 1 million Bitcoins, which he received in the early days for his computing power on the network. To date, these Bitcoins have never been moved despite record prices of up to $69,000 USD. The rewards were issued according to pre-determined rules: First 50 Bitcoins per block, then 25, then 12.5, and so on.

Each so-called halving, which takes place every 4 years or so, reduces the rewards through mining. There are no other ways to get Bitcoins. In contrast, Ethereum, for example, has issued so-called pre-generated tokens without a corresponding proof of work (pre-mine). The founder of Bitcoin has his multi-billion dollar Bitcoins have not been moved or sold once so far. This is very different from Ponzi schemes, where the people in charge constantly try to turn their fraudulent scheme into their own money, because they are aware that it could soon be exposed.

No central authority

Satoshi Nakamoto's idea was passed into the hands of other people, but it still evolved. The anonymous “inventor” retired after he was sure the network was big enough to stop failing.

Value vs. price

Bitcoin has existed since 2009, but there was no price for it until mid-2010. In the beginning, there was no set price. Unlike Ponzi schemes, where a certain price is always set, and it is often claimed that the price will reach a certain value in x years, there was no price setting for Bitcoin. It is a pure credit system that does not pay interest, dividends, or promise returns. You can be in with as little as 0.00000001 BTC, or 1 Satoshi – regardless of whether this equates to 0.1 Euros or 0.00000001 Euros. In contrast, many Ponzi schemes have fixed package prices such as 250 euros, etc.

Uniform worldwide

The Bitcoin network works uniformly worldwide. There are no differences in handling or participation as a node/miner/user. It is one system for everyone, regardless of their country. This of course increases the global verification aspect. Bitcoin is and will remain open source, so it is public, transparent, traceable, verifiable and analyzable.

Network changes only by majority consensus

Potential changes in the Bitcoin network require a majority consensus. In Ponzi schemes, backers set the rules and changes often occur overnight. “Rapid” technical changes are not possible with Bitcoin.

Behind I don't care

“Who is the greater Fool?” This means that everyone should come after me to buy more Bitcoin so that I can sell my shares/pieces better. However, it is important to distinguish between the price and the functioning of the network – both are independent of each other and only have a direct impact on the miners but not the holders of Bitcoin.

Network growth independent of price

Bitcoin's history shows continuous and organic growth, which can sometimes seem exaggerated, but can also decline sharply. Nevertheless, the network continues to run. The correlation between hash rate/computing power on the network and price is not consistent and only holds for short periods of time.

Multiple networks

In addition to the mainnet, so-called 2nd layer solutions are also becoming established, such as the Lightning Network, which enables extremely fast and inexpensive transactions while maintaining the security of the mainnet. In a Ponzi scheme, there is usually a greater interest in larger transactions to embezzle more volume. Bitcoin, on the other hand, enables faster and faster transfers of smaller and smaller amounts.

No boss – no listing fees

Centralized exchanges (CEX) are typically paid to list a coin or token. This is often justified by implementation costs and ongoing “support”. However, Bitcoin has demonstrably never paid such a listing fee, as there is no CEO or Bitcoin headquarters.

Bitcoin as the ultimate security deposit

Compared to other cryptocurrencies, Bitcoin is not only considered the first use case of the blockchain, but also the biggest crypto asset with the most users, wallets, transaction volumes, etc. Interestingly, Bitcoin is held by many crypto companies as a collateral deposit, much like gold is held by central banks. There is a reliance on this digital gold to hold it for the long term. Why? Bitcoin is accepted worldwide, is highly fungible, and there is a liquid market where it can be sold at any time. In contrast, with other projects, there is no certainty that you can quickly access or sell your assets.

No brokerage commissions

There are no referral commissions with Bitcoin. No one receives a reward for buying or recommending Bitcoin. There is no mechanism in place to allow this to happen. Sure, you can recommend other people to buy Bitcoin, but you get nothing if they then actually buy Bitcoin. The Bitcoin price may go up, but that does not depend on getting other people to buy Bitcoin. In contrast, internet scammers who want to get people to pay into a pyramid scheme often advertise high interest rates and returns.

No referral structure

Bitcoin does not have a referral structure, like other pyramid schemes. In pyramid games, older participants recruit new participants to profit from their deposits. However, in Bitcoin, there is no sales structure. There are no sales people actively recruiting new participants, and accordingly, there is no referral structure typical of pyramid games.

No promised returns

Unlike internet scammers who promise high interest and returns in Ponzi schemes, there is no guarantee of returns with Bitcoin. Bitcoin's whitepaper does not promise returns or interest. There are only rewards for helping the network. Bitcoin offers no direct benefit to people who invested in Bitcoin early. No one can predict the Bitcoin price. In contrast, Ponzi schemes make specific promises of returns over the next few months or years.

A nice quote from Satoshi Nakamoto or attributed to him is, “Bitcoin has no dividend or potential future dividend. It is more like a collectible or commodity.”

Summary

The claim “Bitcoin is a Ponzi” comes from ignorant people. In 2023, there is a wealth of high quality literature, both online and in print, that addresses this topic. Anyone who studies this fascinating subject just a little will come to the unequivocal conclusion: Bitcoin is not a Ponzi or Ponzi scheme.

So if you meet people on social media or in personal conversations who still believe in a Ponzi or Ponzi scheme, you can simply forward this article to them.

About the author:

Matthias Reder changed the technological “side” from value date to value second in 2018. After 20 years in banking, he moved to Austria's oldest Bitcoin broker based in Graz: Coinfinity, where he started as Head of Compliance and AML responsible for the successful registration as a service provider regarding virtual currencies and on-site audits. Since 2021, he has been working there in the function Bitcoin Key Account Manager as contact person for large-volume transactions. On the side, he runs his own financial blog RETTE DEIN GELD and is an external lecturer at the University of Applied Sciences Burgenland in the field of cryptoeconomics. Furthermore, he is also active as a book author and lecturer.

🟡 Liquid Staking Derivatives

written by Krzysztof Gogol

Liquid Staking is one of the hottest topics in crypto this summer. Lido’s Liquid Staking Token - stETH - just became the 7th largest crypto-currency with 14bn market cap, greater than Cardano, Polkadot, Solana and other chains.

What is more, liquid staking is the largest group of DeFi protocols, when counting Total Value Locked (TVLl), according to DeFi Llama. Lido, which issues the stETH tokens – became the largest DeFi protocol (by TVL) earlier this year, overtaking MakerDAO’s decentralized stablecoin DAI.

So what is Liquid Staking and Lido Staked Ether token?

You might have heard about stablecoins – tokens whose value is pegged to fiat currencies (typically 1 USD) or commodities (like gold). Some stablecoins – USDT (Tether) and USDC (USD Coin from Circle) – are also listed in Figure 1, and have a value pegged to 1 USD.

Lido Staked Ether (stETH) works similarly to stablecoins, but its value, instead of being pegged to 1 USD, is pegged to 1 ETH. What is more, every day the stETH holders receive extra tokens of stETH as staking rewards (ca 4-5 % p.a. at the time of writing).

What is staking?

This year Ethereum, the first smart-contract blockchain, success moved from the Proof-of-Work (PoW) to Proof-Of-Stake (PoS) consensus mechanism, reducing its electricity consumption by more than 99%.

In PoS blockchains, the security and integrity of data in a ledger is guaranteed by validators, who put their tokens at stake. In case of cheating (or unavailability), their tokens are slashed, typically by 10%. In exchange for the support in maintaining the blockchain network, the validators and stakers, who provide them their tokens, are rewarded (via staking rewards).

What are Liquid Staking Derivatives, and why do we need them?

Staking is a relatively low-risk token allocation strategy, in which slashing is the major risk (validator being punished losing about 10% of staked tokens for dishonest behaviors or unavailability). However, tokens that are provided to validators for staking are locked in the staking process, with a withdrawal period of about 1-2 days.

Liquids Staking Derivatives, unlike staked tokens, are fully liquid – you can trade them at any time at centralized (Binance, Kraken) or decentralized exchanges (Uniswap, Curve). What is more, LSDs can be used as collateral when taking a loan or allocated to liquidity pools at AMMs (automated market makers) for extra yield from trading fees.

DeFi Looping

The popular allocation of LSDs is called “looping”, similar to leverage in traditional finance (TradFi). In this DeFi strategy, LSD tokens are used as collateral with a DeFi lending protocol (like Aave, or Compound) to borrow ETH. This ETH is later exchanged into LSD, which is used as collateral in a new loan. By repeating this process 4x, the staking reward might grow from 4% to 16%. However, this strategy is not risk-free.

Risk

The major risk of LSD, like for stablecoins, is the risk of loosing its peg. Historically, there were small deviations of stETH from the value of 1 ETH.

What are other LSDs?

Lido was the first LSD and has the first-mover advantage. However, there are other challengers on the market – Rocket Pool (rETH), Liquid Collective (lsETH), and Coinbase (cbETH), just to mention a few.

Where stETH distributes a staking rewards as daily “airdrops” of stETH, other LSDs choose different mechanisms. LSD –- rETH, cbETH, lsETH –- accumulate staking rewards in the token value without changing the token balance. For example, if you have 1 stETH, in one year you will have 1.04 stETH, and the value of 1 stETH both today and in 1 year will be 1 ETH. However, when you have 1 rETH today, in one year you will still have 1 rETH, however, its value will be 4% higher.

The other differences between LSDs include the selection of validators to work with. Lido, for example, operates only with a group of whitelisted validators. Rocket Pool, on the other hand, is permissionless – any validator can work with Rocket Pool, on condition that it deposits collateral. In case of a slashing event, the penalty is taken from the validator’s collateral.

The last difference is the treatment of rewards from MEV attacks. MEV attack are performed by blockchain validators that re-order transactions in the block so that the validator can profit from it. The MEV attack is similar to front-running in buying shares by brokers that was forbidden in finance in 80s. Rocket Pool distributes the earning from MEV attacks to its LSDs token holders.

Last but not least, LSDs charge fee for the services they provide. It is typically ca 10-20% of the staking rewards.

About the Author:

Krzysztof is a tech entrepreneur and accomplished professional with expertise in the field of blockchain, decentralized finance (DeFi) and FinTech. Currently serving as a PhD Candidate at the University of Zurich, Krzysztof is actively involved in researching decentralized finance protocols and their multi-chain architecture. He has been actively engaged in supporting and advising numerous projects in the areas of DLT, blockchain, and DeFi. Furthermore, Krzysztof brings experience as the founder and CEO of a successful fintech company in the wealth management space.

🟢 Race for the Bitcoin ETF

written by Pascal Hügli

Seemingly out of nowhere, the starting gun sounded recently for the Bitcoin ETF race. How so? After all, there are already a few bitcoin ETFs in the US (BITO, BITI, XBTF or BTF) and there are also still a few bitcoin ETF applications pending with the US Securities and Exchange Commission (SEC).

However, the ETF news that has reached us in recent weeks is of a different caliber. For one thing, unlike the already approved ETFs, this time it is not about futures-based products, but spot vehicles. Secondly, the companies applying are not Bitwise, Coinshares or ARK/21Shares, but WisdomTree, Fidelity, or BlackRock. So it is the TradFi giants that are now starting to get involved.

Fidelity and BlackRock have attracted particular attention. With assets under management of an impressive $4.5 trillion and $10 trillion, respectively, these two financial giants are undoubtedly among the largest asset managers on the market. While BlackRock is focused on a bitcoin spot ETF, Fidelity, for its part, has not only filed a bitcoin ETF application, but there is also speculation that the company may be interested in acquiring Grayscale. Grayscale is the most prominent provider of closed-end crypto trust funds (GBTC, etc.), which played a price-fueling role in the 2021 bull run in particular.

The euphoria on the market about these proposals was great – so much so that bitcoin has climbed above the 30,000-dollar mark in the past two weeks, and many have already even proclaimed the end of the crypto winter that has lasted since the end of 2021.

BlackRock: really such a big deal?

The fact that players like BlackRock are now not only participating in the crypto market through strategic investments, but are also pushing into the crypto world with their own spot ETFs and thus with the core financial products of our current financial world, shows the importance they attach to this market in the near future. For example, Larry Fink, CEO of BlackRock, recently noted that tokenization of asset classes such as equities or bonds (RWAs), will increase efficiency in capital markets, shorten value chains, and improve cost and access for investors. As a pioneer in the securitization of all types of debt, Fink obviously knows what he's talking about.

But by applying for a bitcoin ETF, BlackRock and other traditional financial services firms are proving that their interest is just as cryptocurrency-specific. Thus, it should also be clear to the Wall Street giants by now that crypto will be the asset class of the young, future generations. They are already sensing the future potential to earn fees accordingly.

ETF or not?

Crypto bros and blockchain enthusiasts feel their assumptions have been confirmed by the now serious competition for a Bitcoin ETF – an Ether ETF is sure to follow, this digital asset is even more attractive to traditional investors due to the PoS sustainability narrative and the staking “yield”.

Once again, it was some Bitcoin hardliners who tried to curb the euphoria. Their criticism went to the roots: are the products applied for by BlackRock and Co. really an exchange traded fund (ETF) in the true sense? After all, BlackRock writes in its application letter about an “iShares Bitcoin Trust” and not about an ETF.

Of course, this skepticism was dismissed as petty pedantry from various quarters. The BlackRock product would ultimately provide for an issuance and redemption process by so-called “Authorized Participants”, which puts the whole thing close to an ETF from a practical point of view. So why all the fuss? Well, there is a reason why this quibble has been noticed and criticized by Bitcoiners in particular. We will discuss this in a moment.

Experts have also confirmed that it is quite correctly not an actual ETF. What BlackRock wants to have approved by the US supervisory authority is a so-called "grantor trust". This fund structure is used especially for “commodities”. BlackRock's approximately $60 billion gold ETF is also actually such an exchange-traded trust.

A declaration of war on bitcoiners

Whether it's a trust or an ETF, in practice it has no real impact on the ordinary investor and the two are actually on equal footing. However, that's not the case for those who care about the underlying asset, bitcoin. This, according to some Bitcoiners, could be in jeopardy as BlackRock could launch an attack on Bitcoin through their investment vehicle.

For example, BlackRock also writes in its application letter that there is no guarantee after which the sponsor (BlackRock) will choose the digital asset that ultimately proves to be the most valuable in the event of a fork (a split of the blockchain into two new chains). Thus, and this is the fear, the world's largest asset manager could push through a new version of Bitcoin adapted to the preferences of the US government – Bitcoin Uncle Sam's vision, that is.

The main problem would then be the following: Whoever as a trust holder does not agree with this step and wants to proceed against it by means of redemption (redemption) of the trust certificates would have hardly any chance to get the underlying Bitcoin. Because BlackRock's product is not an actual ETF, but a trust, there is no legal possibility to sue for such a refusal of redemption by BlackRock. One would then only have to hope for the economic incentives that should deter BlackRock from such an attack in the first place.

What are the chances?

Whether BlackRock is actually working towards a major attack against the cryptocurrency with its planned Bitcoin product launch cannot be conclusively answered today. First, such a product (or one of those launched by BlackRock associates) must be approved anyway. In this regard, there are two main arguments that the US Securities and Exchange Commission could use to reject such a Bitcoin Spot ETF:

Spot Bitcoin can still be manipulated.

There is currently no spot exchange of “sufficient size” under the Surveillance Sharing Agreement with Nasdaq.

It is interesting to note that BlackRock has announced in its application that it intends to enter into a Surveillance Sharing Agreement with the Nasdaq exchange. This is an agreement to jointly monitor the bitcoin trading market on exchanges where the ETF would be listed. The agreement provides for the exchange of information on market trading activities, clearing activities and customer identity between trading venues. This is intended to provide a comprehensive monitoring mechanism to detect and prevent market manipulation, a concern that is critical for the U.S. Securities and Exchange Commission when reviewing ETF applications.

By including this agreement, BlackRock is clearly signaling its intentions to comply with the SEC to the best of its ability. However, there is still one “problem” that remains: Binance. The world's largest crypto exchange still has a weighty influence on Bitcoin pricing. In view of Wall Street's ETF intentions, it is therefore hardly surprising that the US regulator filed a lawsuit against Binance a few days earlier.

Binance's influence is already on the wane. In various countries, the crypto exchange has had to cease its activities due to pressure from the local regulator. Will that be enough for the US establishment? As far as the bare numbers are concerned, BlackRock has an excellent record: 575 of the 576 ETFs applied for have been approved for the asset manager so far.

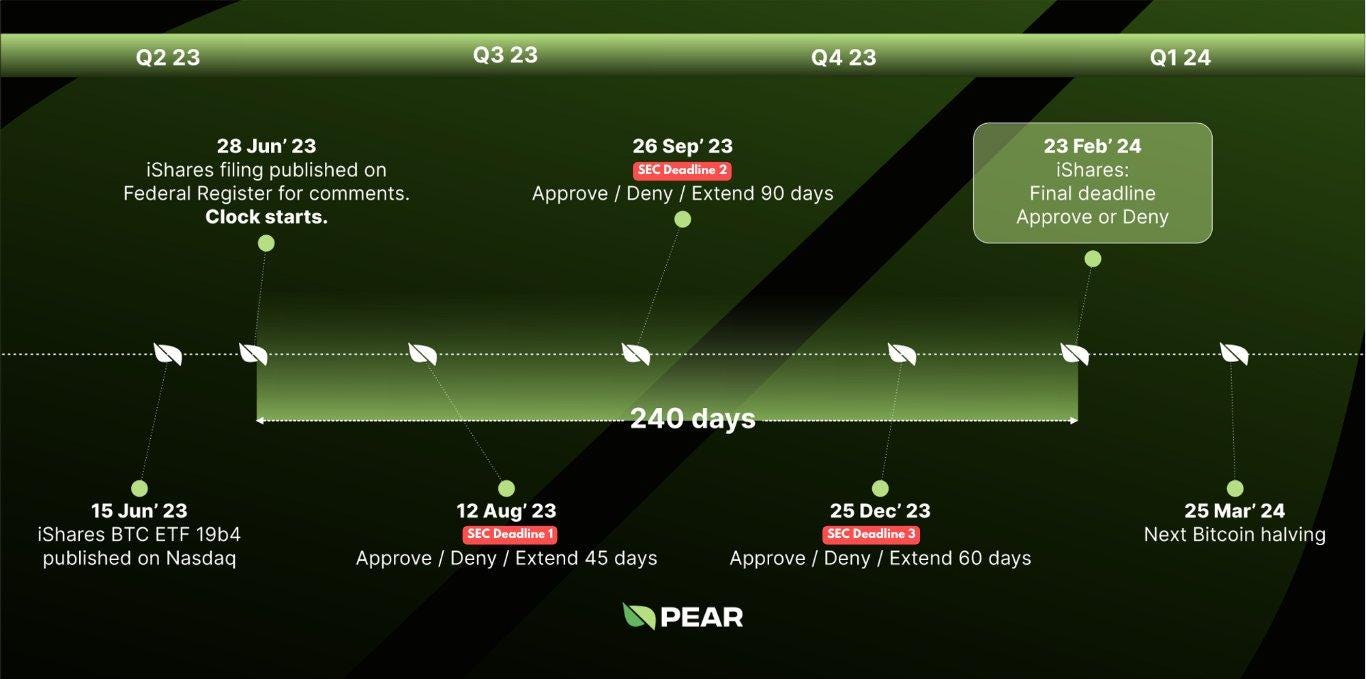

What about the timeline?

When is the earliest that BlackRock ETFs could be approved? As the chart below shows, there are three possible deadlines, the first of which is as early as August 12, 2023. However, in addition to BlackRock, well-known tech investor Cathie Wood with ARK/21Shares is also waiting for a possible approval. Here, a decision could also be due very soon.

And a lot could also go Grayscale and its ETF application in the coming days. The company has filed a lawsuit in court against the SEC after its application for the Grayscale Spot Bitcoin ETF was denied. There is speculation that judges may rule in favor of Grayscale, which would mean the U.S. Securities and Exchange Commission would be forced to approve the ETF.

The big coup, of course, would be if BlackRock received approval for its ETF on Feb. 23, 2024. That date would then coincide fairly closely with the next bitcoin halving and could then naturally boost the price.

This article will also appear in Payoff Magazine (German only) on July 6.