Euphoria is harmless; unless it is boundless

Ethereum Shapella Update, MiCA Regulation, Liquidity and Debt Ceiling, Streaming Money, Narratives in April, Memes

Let’s gooo 🎢 What to expect:

Knowledge-Level : 🟢 Beginner| 🟡 Advanced | 🔵 Expert

Market Update: Is the EU outpacing the US when it comes to crypto? 🟡

Liquidity Corner: What’s flowing? 🟢

All eyes on... 🟡

Narratives worth watching in crypto markets 🔵

Meme Section 🟢

Insight DeFi on Social Media: LinkedIn / Instagram / Twitter / YouTube / Telegram

Note: Apparently there is currently a conflict between Twitter and Substack, which is why the Twitter links (tweets) are currently not actively displayed. However, we have linked them to the individual images.

🟡 Market Update: Is the EU now outpacing the US when it comes to crypto?

written by Pascal Hügli

Macro & Crypto

Since our last newsletter post, Bitcoin has managed to quickly break the $30k barrier. After a so-called retest and climbing back up above the $29.7k level in the middle of this week, there was the wide belief that the cryptocurrency would attack the $32k resistance level.

However, this did not happen, and the bitcoin price moved in the other direction. As it seems, the euphoria was now a bit too high after all, and a correction was therefore necessary. How far could this go? Some traders see a first level at $27,800 – and if this is not held, lower prices are likely in the short term. A re-buying opportunity could be in the area around $25k:

🔭 Zoom out: Globally, the liquidity situation has deteriorated in recent days (see Liquidity Corner). If liquidity dries up, it should feed through to risk assets, especially Bitcoin, which had a strong Q1 2023. Moreover, the recession outlook, driven by the ensuing credit crunch, does not necessarily make risk investors feel positive either. Risk assets are still likely to be supported by the Fed's increased bank reserves – even if liquidity is gradually thinning…

Ethereum Shanghai Update (Shapella)

Defying renewed prophecies of doom (especially from the bitcoin maximalist corner), Ethereum has now successfully implemented the planned Shanghai Update (Shapella). This update to the code allows validators (block producers), colloquially also called stakers, to withdraw coins provided to the protocol for securing the blockchain. So with the implementation of this update, Ethereum is no longer a “one-way door”. From now on, anyone who wants to stake will not only be able to get in, but also to get out.

However, in order to unstake ether, one has to join a queue. The portal set up by Nansen provides a precise overview of what the figures behind this queue currently look like. What we can state, is this: As feared by some, the majority of validators are not leaving the blockchain. Out of a total of 570,000 validators, there are about 26,000 who want to pull their ETH.

And important to note: As a validator, you can either drop out completely and then withdraw all your staked Ether. But then you are no longer contributing to the security and maintenance of the Ethereum blockchain. Alternatively, there is also the option to withdraw only the staking yields (rewards) and not the entire stake.

The market considered the update a success. Shortly after the implementation, the ETH price climbed above the $2,000 level and successfully defended it. For those who want to estimate the possible selling pressure over the next few weeks, there is this aforementioned queue to watch.

As far as withdrawals (withdrawals) are concerned, it is primarily the crypto exchange Kraken that is withdrawing. This is not surprising, as the exchange has been banned from providing staking services in the US due to regulatory measures. In terms of protocol, the uncertainty surrounding staking has naturally fallen somewhat. This leads to the expectation that more and more Ether will be staked over the coming weeks and months. After all, only a little over 14% of the total circulating ETH supply is still staked. A look at the net deposits over the past 24 hours reveals that these are far in the plus, with almost 100,000 ETH.

🔭 Zoom out: Staking has been further legitimized with the successful implementation of the Shapella upgrade. More and more traditional financial service providers (see news in Switzerland) will offer staking services. While the Ethereum protocol will have inflows, other proof-of-stake blockchains will also benefit.

Regulatory THEATER USA

The U.S. regulator, the SEC, remains committed to regulating the crypto sector in the U.S. (dead). It proves its seriousness in that it now wants to target the world of decentralized finance (DeFi) more closely. Thus, the SEC believes: Decentralized trading exchanges, or DEXes, also fall under the traditional definition of securities trading, and therefore these DEXes must also follow the same rules as traditional exchanges do.

In order to enforce this view, the SEC would ultimately have to expand its definition of a securities exchange – only then could DEXes also be officially regulated. A proposal to seek this change was approved within the SEC by a vote of 3 to 2.

In addition to DeFi, the SEC has also sued formerly prominent crypto exchange Bittrex for operating an unregistered securities exchange, broker, and clearinghouse. The charges follow the announcement a few weeks ago that the exchange would cease operations on April 14 in the U.S. due to the regulatory unfavorable environment.

Bittrex responded to the SEC's accusations with a tweet, accusing the U.S. regulator of non-cooperation. Even after repeated requests, Bittrex had not provided any information on which specific digital assets were to be classified as securities by the SEC.

And Bittrex is not alone in this accusation: even US politicians accuse the supervisory authority of operating without clear rules and presenting various crypto providers with a fait accompli with after-the-fact regulation.

Recently, the chairman of the SEC, Gary Gensler, was therefore invited to a so-called hearing where he had to answer questions. As is customary in the US, Gensler was given a grilling and as a crypto advocate one was not quite sure whether one should feel sorry for poor Gary or not.

One thing is clear: the SEC does not have an easy job. In the USA, there are no clear rulings to guide the supervisory authority. That's why everything seems very vague and ambiguous. However, clear communication from the SEC would be an advantage for crypto players operating in the U.S., as they would at least have guard rails to orient themselves by. The SEC would have to take a clearer position here and demand such guard rails.

It is also the case that the regulatory authority has probably failed more than once. The most famous example might be FTX. They even met with this crypto exchange twice, according to public records, and yet in no way saw the collapse coming.

However, Gensler and his troops must be taken to task: Unfortunately, many DeFi projects that claim to be decentralized are in fact not. Of course, it is important to separate the wheat from the chaff. This would be possible by means of a clear framework that states exactly when a protocol/project is really decentralized and when it is not. However, it seems that the SEC does not want to be carried away by such a clear framework. After all, Gensler even struggled to clearly answer the question of whether or not ether is a security – and probably with good intentions:

🔭 Zoom out: The regulation issue will be with us for some time, especially in the USA. As it seems, this topic has long been politicized and is therefore no longer easy to answer. It will ultimately be up to political influence what answer will come out of this. Due to the positive influence crypto already has on US politicians and the financial sector, one is inclined to assume that a positive decision will be made one day. For the time being, however, we will have to wait and see. In the meantime, smaller jurisdictions will benefit as they are faster, more agile, and therefore have clear regulations. Positive news has also reached us from the EU. Probably the most comprehensive crypto regulation (MiCA) was approved by a majority within the EU Parliament. The law should come into force in 2024.

🟢 Liquidity Corner: What’s flowing?

written by Pascal Hügli

A look at the numbers:

Net financial liquidity in the U.S.

April 7 (last newsletter issue): $5,527 trillion

April 21 (today's newsletter issue): $5,318 trillion

↙️ Reduction of $209 billion

Reverse repo programs in the USA

April 7 (last newsletter issue): $2,240 trillion

April 21 (today's newsletter issue): $2,277 trillion

↗️ Increase of $37 billion

U.S. Treasury General Account (The U.S. government's “bank account” at the Federal Reserve).

April 7 (last newsletter issue): $111 billion

April 21 (today's newsletter issue): $265 billion

↗️ Increase of $154 billion

Over the past two weeks, overall liquidity in the US financial system has declined. The bitcoin price was initially unimpressed by this, but as the ultimate liquidity barometer, it should have a delayed reaction as this discrepancy is unlikely to hold.

These signs can now be observed, and the bitcoin price has weakened over the last few days. A crucial short-term factor that is directly relevant and leading to a “liquidity problem” is likely to be the US debt situation. Thus, the U.S. government has continuously emptied its “bank account” at the Federal Reserve over the past months.

It is true that the taxes that became due in mid-April once again flushed $108 billion into the coffers. However, mainly due to the poor stock year in 2022, capital gains taxes have been massively lower, which is why this year's tax revenues seem downright paltry compared to last year ($298 billion flowed into the US treasury last year).

Of course, it is clear that the U.S. government must fund itself somehow. The Treasury, for example, has warned that it may not be able to meet its own financing needs as early as June 5.

So the discussions, indeed the “drama” about the debt ceiling, have been set off again. As it turns out time and again, the drama is just an act and the debt ceiling is not a real ceiling. Theatrically, the “shutdown” is proclaimed each time to scare the public, only to take on new debt. This time will be no different. If you want to make sure that this debt ceiling does not exist, take another look at the rapidly turning, absurdly appearing U.S. debt clock:

At this point, we should be interested: But what are the immediate consequences of this new debt increase for the markets? If the debt ceiling is raised upwards, the US government will finance itself primarily by means of new long-term US government securities. In other words, new government bonds will come onto the market and the greater supply will have to be absorbed by the markets.

A larger supply in the face of potentially subdued demand (the U.S. Federal Reserve, at any rate, still wants to stick to its QT policy) puts pressure on prices, which in turn causes the interest rates (yields) of these bonds to rise. Rising market rates, again, are bad for equities and risk assets like cryptoassets. At the same time, liquidity flows out of the markets from the buyers of these bonds and is credited to the TGA (the U.S. Treasury's “bank account” at the Federal Reserve). Only when the government spends this money again does it return to the market.

The current liquidity situation looks really positive, not least because of the upcoming TGA issue. In this situation, the central bank reserves held by commercial banks at the Fed could have a counteracting effect. The Fed has shown that it will make reserves available to banks via emergency programs if they need them. More reserves, in turn, mean more liquidity. This is because increased credit creation and risk appetite with increased bank reserves has led to a positive correlation of the same with the S&P500.

🟡 All eyes on...

written by Pascal Hügli

Streaming Money: Payments at the speed of light

Internet payments, where value circulates as fast as data, have always been part of the vision of the early Internet pioneers. Blockchain technology, together with its scaling solutions, should finally make this promise a reality.

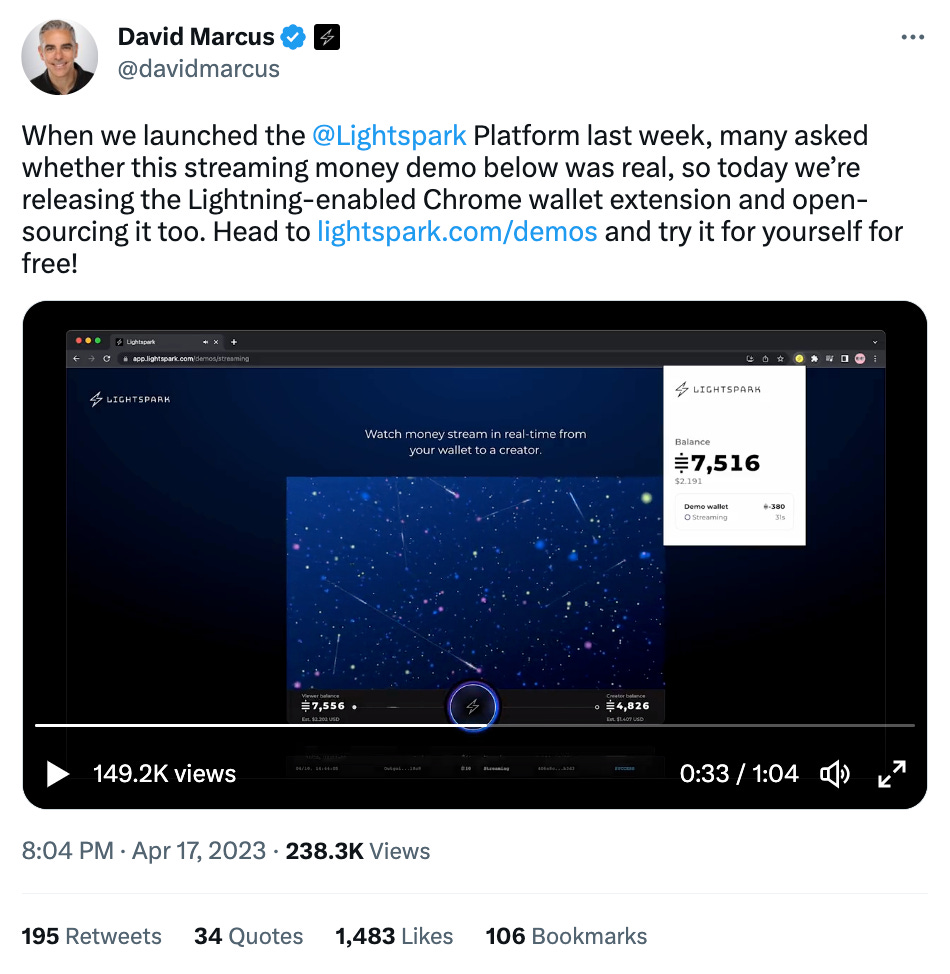

For example, the Lightspark payment platform was recently unveiled. The company uses the Lightning network to enable users and other entrepreneurs to make fast, low-cost global payments online. The co-founder of this solution is former PayPal president David Marcus, who also pushed Facebook's stablecoin project called Diem (formerly Libra) a few years ago before it was shut down due to regulatory pressure.

Today, Marcus believes in the Lightning network and thus Bitcoin. His conviction is that with this new technology stack, money can be sent as fast as or even faster than an email:

Lightspark was founded in 2022 and interested users can already test the solution today with the Chrome extension. Here is the test version:https://www.lightspark.com/demos

On other blockchains, most notably Ethereum and its scaling solutions, such streaming money services have been live for some time. Two existing solutions are: Sablier and Superfluid. So if you want to have your wages paid out every hour, every minute or even every second instead of just once at the end of the month, go to your employer today and suggest switching to crypto.

Receive money directly with the email address

And by the way: Also exciting is the fact that Lightning addresses can now also be configured as email addresses. Bitcoin bull Michel Saylor believes that Lightning addresses will one day be as popular as e-mail addresses. His company MicroStrategy has already converted his corporate email address into a Lightning-compatible address so that he can receive Bitcoin via his email address using Lightning payments:

For you can do the same, some Bitcoin companies have already ventured into this area. You can find a selection here:

Not on the list, but also enabling Lightning addresses, is the Bridge Wallet from Mt. Pelerin. We at Insight DeFi have been using this wallet for quite some time and therefore also have a wallet email address: insightdefi@ln.mtpelerin.com. So if you want to send us some sats, go ahead ;)

And yes, if you want to make your very own email address with your own domain, you already have this possibility today – only the implementation requires some technical know-how. Our colleague Gabriel Comte has written these instructions below:

### How to create a Lightning Address for your own domain using Wallet of Satoshi

1) Think of the lightning address you want to have. It will be <your-user>@<your-domain>.

2) Install Wallet of Satoshi on your phone: https://www.walletofsatoshi.com/

3) Lookup your <wos-address>: Tap "Receive", switch to the tab called "Lightning Address". Your <wos-address> is something@walletofsatoshi.com .

4) We're particularly interested in the first part of your <wos-address>, the part before the @-sign. We're gonna call that part <wos-user>.

5) Open https://walletofsatoshi.com/.well-known/lnurlp/<wos-user> in your browser. Safe that website. Give the file the name <your-user> . No file ending.

6) Move that file onto your webserver, into a newly created directory structure: .well-known/lnurlp/

7) If you did everything right, you can now see the file when you open <your-domain>/.well-known/lnurlp/<your-user> in your browser.

8) Your new lightning address works! Open another Lightning wallet (not your Wallet of Satoshi) and try to send to your new address.

For all non-bitcoiners only. Of course, this has been possible with email addresses on Ethereum for quite some time. We have already reported on blockchain Internet addresses in a previous newsletter. An interesting solution to link an Ethereum address with your own email is also offered by Skiff Email.

🔵 Narratives worth watching in crypto markets

written by Yash Palod and Prithvir Jhaveri

Narratives worth watching in crypto markets, April 2023

Bitcoin's breakthrough beyond $30,000 marked a significant turning point in the market, as its value increased amid the failure of large regional banks. This, coupled with the Bitcoin-based NFT project “Ordinals,” has contributed to a strong narrative for Bitcoin.

Consequently, it has outperformed the broader cryptocurrency market. However, in the past month, its dominance has waned as capital flowed from Bitcoin to Ethereum and select alternative coins. It is important to note that no new liquidity has entered the market; instead, cryptocurrency funds are being transferred from stablecoins into alternative coins.

The macroeconomic climate remains predominantly bearish, with the true impact of interest rate hikes yet to be fully understood. The market's reaction will depend on whether the Federal Reserve unexpectedly maintains rate hikes for a longer duration than anticipated.

Given this context, let us examine upcoming narratives and catalysts to consider and the

tokens that are most likely to benefit from these narratives:

Narrative 1 – Ve (3,3) DEXes:

Solidly is a DEX pioneered by Andre Cronje, a famous DeFi protocol founder and developer. It was built on Fantom and designed to circumvent the cold start problem facing most DEXes. It did this using a veToken model, where veToken holders directed emissions to pools, which were then awarded to LPs in return for the fees of that pool. This kick-started a flywheel effect – token holders lock their tokens – vote for the most productive pools – receive trading fees – lock more tokens – LP emissions get more valuable is token price goes up.

The recent resurgence of Solidly forks can be attributed to the success of Velodrome on Optimism, prompting various Solidly forks to launch on other chains. Two noteworthy projects include:

$VC (Velocore): A Solidly fork launched on ZkSync with $24 million in Total Value Locked (TVL). The project is less than a month old.

$THENA (Thena Finance): A Solidly fork launched on BNB chain with $115 million in TVL since its early January launch.

Narrative 2 – Liquid Staking Derivatives:

Following the Shapella upgrade (see Market Update), which enabled Ethereum withdrawals, Liquid Staking Derivatives (LSDs) are expected to experience substantial growth. This is because LSDs offer a more convenient staking alternative without exposing users to custodial risks associated with centralized platforms like Coinbase staking. Key projects to watch include:

$USH (unshETH): With $32 million in TVL in two months, unshETH is an LSD protocol offering users index-like exposure to various LSDs. Additionally, it features a Curve-style Automated Market Maker (AMM) enabling users to swap between LSDs, with fees accruing to $USH. It also has veTokenomics and a bribe marketplace on its roadmap.

$AGI (Agility): A protocol focused on providing additional yield on LSD tokens, primarily through the emission of its governance token, AGI. In under a week since its launch, the protocol has amassed over $343 million in TVL.

$PENDLE (Pendle Finance): With $62 million in TVL, Pendle Finance is an Arbitrum-native yield-trading protocol that enables tokenized future yield trading on an AMM system. This is ideal for hedging and speculation while minimizing principal risk.

Narrative 3 – Price Discovery:

Market leaders in DeFi and NFTs, $ARB and $BLUR have recently airdropped tokens to loyal users, dominating their respective sectors. Currently functioning as pure governance tokens, they have the potential to implement a fee-switch later. Many on-chain analysts believe that these tokens have yet to undergo true price discovery. In recent months, numerous whales have been accumulating these tokens, coinciding with significant upward price movements.

Other coins worth observing include:

$JOE (Trader Joe): With $127 million in TVL, Trader Joe has released Liquidity Book v2.1, allowing users to create permissionless pools and automated liquidity strategies, enabling LPs to provide liquidity in customizable, capital-efficient ranges.

$LVL (Level Finance): Boasting $40 million in TVL, Level Finance is a decentralized, non-custodial perpetual DEX on BNB Chain, focusing on effective risk management and a unique liquidity solution for LPs using original code designed from the ground up.

$SYN (Synapse): Synapse is a bridging protocol that has seen substantial accumulation by whales recently. Continued accumulation may indicate that Synapse's own roll-up chain is forthcoming, which would serve as a catalyst for the token.

This article was written by crypto experts at Loch. Loch Inc is a financial technology software platform that enables individual retail traders to access hedge fund quality intelligence and analytics at a fraction of the usual cost.

These are a few interesting things you can do with Loch:

Loch algorithmically generates personalized insights to help you mitigate transaction costs, reduce risk, and increase yield.

Loch provides extensive coverage across 1000s of DeFi protocols and the top crypto exchanges by volume.

Loch provides peace of mind and assurance for your crypto assets. It informs you about token unlocks, risky assets, ponzi schemes, and other degen things you may be exposed to.

Please note that none of what is written in this article is financial advice. Below entails an analysis of the current state of crypto markets by our team at Loch Research. Loch Research is the media arm of Loch Inc.

Also, please be aware that this article is written by parties outside of Insight DeFi. Therefore, the content does not necessarily represent the views of Insight DeFi.

🟢 Meme Section

Not a meme but still important: