Mining and the Sustainability of our Industry

Be on the lookout, Bitcoin mining in Euriope, Bitcoin Mining & Energy, Blockchain & Sustainability, Social Side of Bitcoin

Let’s gooo 🎢 What to expect:

Knowledge-Level : 🟢 Beginner| 🟡 Advanced | 🔵 Expert

Market Update: Be on the lookout – the situation is getting worse again! 🟢

Bitcoin mining in Europe: Here is what to expect 🟡

The Harmonisation of Bitcoin Mining & Energy 🔵

Blockchain & Sustainability 🟡

The Social Side of Bitcoin 🟢

Insight DeFi auf Social Media: LinkedIn / Instagram / Twitter / YouTube / Telegram

🟢 Market Update: Be on the lookout – the situation is getting worse again!

written by Pascal Hügli

It can happen that fast. Just a few weeks ago, the euphoria in the crypto market seemed to have returned. Bitcoin briefly touched the 25k US dollar mark, and many hoped that the cryptocurrency would continue to rise.

Today, however, we are not at $30k, but BTC has fallen below the $20,000 US level again. What seems evident by now is the fact that the “echo bubble” that we mentioned back in January, has come to an end.

Changing tides on the macro level

This has already become apparent in the past two weeks. In particular, the liquidity coming out of Asia since the beginning of the year has gradually subsided again. China in particular has hit the brakes, which does not seem to please Bitcoin.

Thus, the correlation between the PBoC (China’s central bank) and the mother of all cryptocurrencies cannot be overlooked. However, Bitcoin is also likely to suffer from what some market observers have been expecting for quite some time: the price upswing just experienced at the start of the year can only be short-lived, as the macroeconomic situation is unlikely to change for the better in the medium term. Rather the opposite should be the case, because apart from China not coming to the rescue:

the money supply is currently decreasing ⬇️

the liquidity at all central banks is declining ⬇️

the U.S. wants to keep interest rates higher for longer ⬆️

interest rates and the dollar index (DXY) have resumed their upward trend ⬆️

yield curves becoming more and more inverted

So yes, if the macro wind turns, so does the bitcoin price – that much the last few days have proven to us once again. The question that many have been asking: Is it getting worse now after this early year 3-months breather?

The money printing machine is on hold

We must not forget: We are still in a fiat money system based on debt. The system’s greatest danger is when the “money printing machine” stalls, financial liquidity dries up quickly.

And that is exactly what is currently under way: Central banks are fighting inflation by shutting down the money printing machine. However, this strategy has a big catch, and it is gradually coming to light: Either the money printing machine is turned on again or everything collapses.

When the money printing machine stops, the “most dynamic and risky” industries are the first to feel the impact. This is also the reason in 2022 various crypto players such as Terra Luna, Voyager, FTX, BlockFi, Three Arrows Capital, Genesis Lending, Gemini have either had to declare outright bankruptcy or have at least been pushed very close to the financial abyss.

Silvergate: the next domino to fall

The latest casualty that has certainly helped fuel the bitcoin correction of the past few days is Silvergate Bank. The financial institution is a comparatively small bank, but its importance to the crypto world should not be underestimated. As one of a few banks in the U.S., Silvergate Bank provides – or rather, offered – access to the banking system for numerous crypto companies.

Thus, Silvergate – also as a result of the FTX debacle – experienced a run on the bank in recent days, with various customers withdrawing their money. Among them were well-known crypto institutions such as Coinbase, Circle, Paxos, Crypto.com, Bitstamp, Cboe Digital Markets, Galaxy, or Gemini.

The loss of customer funds was eventually so great that the bank had to announce last Thursday that it would have to close its doors. And that, of course, immediately made the crypto market’a bellyache grow stronger.

Bank runs: not a good omen

While bank runs brought about by the interest rate hikes are propagating within the crypto world (which ultimately has a cleansing effect), other industries are also experiencing increasingly serious problems.

As we write these lines, another bank run is looming, and it's happening at Silicon Valley Bank. According to various reports, quite a few customers are trying to withdraw their money from the bank without success:

Silicon Valley Bank (SVB) is a bank headquartered in California. It was founded in 1983 and has since specialized in providing financial services to technology companies and venture capital funds, or VCs. It is one of the largest and best-known banks in this field, and has also partnered with many other banks and financial institutions around the world.

And that's exactly what's problematic. The bank is also likely to have many relationships with crypto firms and venture capitalists from within the space. And these are having to watch yet another counterparty collapse before their eyes. The bank's stock fell more than 60 percent on Friday.

The contagion risk posed by a collapse of Silicon Valley Bank could be many times greater than FTX's, given SVB manages over $170 billion in deposits.

Is anything breaking yet?

The situation surrounding Silicon Valley Bank is precarious and having market participants increasingly worried. First the collapse among crypto players and now more players seem to be affected. Quite a few commentators already feel eerily reminiscent of the Bear Stearns implosion just before the 2008 financial crisis.

After all, it is true that interest rate hikes and quantitative tightening (QT) do not show up after a few weeks, but it can take months or even longer than a year.

What if that moment has come now? After all, the losses in the banking system are steadily growing higher and the reserves of the smaller banks in particular are almost non-existent. This is not a good sign and could indicate that the Federal Reserve is just about to go too far with its financial tightening...

Here is our take-away

So while the “soft landing” efforts by Jerome Powell and the central banks may fail and this would radically change the overall picture, here are the headwinds we need to keep an eye on in regard to the crypto market:

Once again, it has been announced for April that the Mt.Gox situation will finally be resolved and the many creditors should be getting their hands on the approximately 140,000 BTC. If this is indeed the case, the question arises: will the majority sell to realize their high profits. This is hotly debated.

Also set to go live in April is the Ethereum Shanghai update, which should finally allow stakers to withdraw their Ether after more than two years. Again, there is an intense debate about whether this event will lead to heavy selling and thus strong downward price pressure on ETH.

Crypto lender Voyager Digital, which went bankrupt in 2022, was granted permission by a U.S. judge to sell its assets to Binance.US for $1.3 billion. It is difficult to estimate when these liquidations will be completed. But until then, they will exert downward pressure on prices.

What is certain is that these forced liquidations will once again impact crypto market prices in the short-term. From our point of view, it therefore makes sense to wait and watch out for the first signs of improvement in this liquidation matter. Should the dreaded “credit event” occur, and thus the entire financial system be shaken up once again, the cards would be reshuffled anyway.

The Bitcoin price would certainly not be unaffected. Given that Bitcoin is one of the most liquid assets globally today, it can and will be sold off quickly and easily in a liquidity crisis.

Of course, such a liquidation cascade would also be accompanied by learning effects about our ailing monetary and financial system. Those investors who are learning along the way and thus finally come to understand Bitcoin will recognize the cryptocurrency as a way out and thus seek personal exposure. And yes, they would then find themselves prepared for the inevitable pivot that must come sooner or later. How soon? Well, should something really be on the cusp of breaking, then the pivot would be just around the corner:

🟡 Bitcoin mining in Europe: Here is what to expect

written by Fabian Weber

Since the start of the Ukraine-Russia conflict in the spring of 2022, one topic has dominated the European media: energy. The dependence on Russian gas has opened the eyes of many that alternative ways are needed to achieve the goals of the green energy transition.

However, the shift to renewable energy sources such as wind and solar power poses challenges, especially in terms of their volatility (see chart) in electricity generation. The chart below shows the power generation in Germany in week 7. As you can see, at the beginning of the week around 15 – 20 gigawatts can be generated from renewables, while at the end of the week even around 45 – 50 gigawatts can be generated. As we will show in this article, Bitcoin mining can play a crucial role in the transformation as well as stabilization of the European power grid.

Bitcoin mining is often criticized for its high energy consumption, while its benefits are often lost in the reporting. However, these benefits can be roughly broken down to two points: First, mining processes transactions in the mempool (a kind of queue). Second, Bitcoin mining secures the Bitcoin network from attack and manipulation through its high energy use. The more energy is in the network (i.e., the higher the hash rate), the more difficult it is for a single attacker to carry out a falsified transaction or to reverse a transaction to a certain block.

On the role of Bitcoin mining in the energy industry

To understand that mining can play an integral role in the transformation of our energy system, let us consider the following situation: On a sunny day in high summer, all solar plants across Germany are producing at maximum power. The problem here is that the electricity is produced at a time when demand is not nearly as high as the supply produced.

If the electricity produced were now to be fed into an already busy grid, this would lead to disturbances in the 50Hz frequency, a situation, which must be avoided at all costs. As a result, electricity producers will have to be shut down, and valuable energy will be lost. 50Hz refers to the frequency of alternating current in the power grid. In Europe and many other countries, the grid frequency is 50Hz, which means that electricity changes direction 50 times per second.

The grid frequency is controlled and regulated by power generators to ensure that the power supply remains stable and that the various loads in a network are coordinated with each other. If there are variations in frequency, this can cause problems in the power supply, including the risk of power outages or damage to electrical equipment.

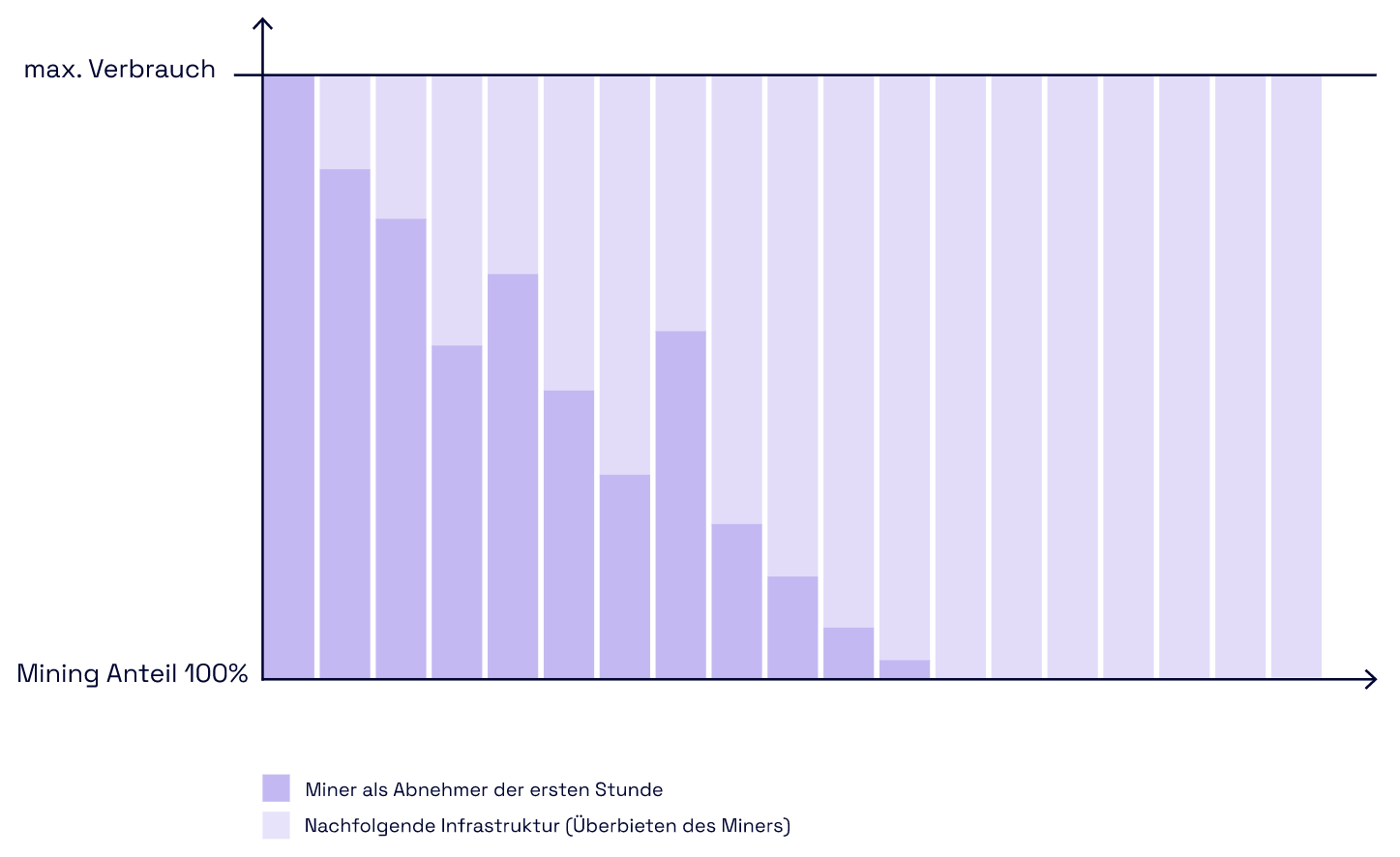

One solution to this issue is storage capacity that can be used during these aforementioned excess periods. However, another option now available to plant operators is the commissioning of a Bitcoin data center. This can be switched on and off within seconds and begins to generate cash flow from the surplus electricity “just in time” after activation.

New economic incentives thanks to Bitcoin

This can create new economic incentives for plant operators to size up or plan their plants better, as they now always have the option of a constant buyer in the form of a Bitcoin miner. Renewable energy has the lowest prime cost per kWh. The cost price of solar energy includes all costs associated with manufacturing, installing, and operating a solar system to generate one kilowatt-hour (kWh) of electricity. Typically, the cost price includes capital costs, operating costs, and financing costs.

Since a miner can only produce profitably at favorable electricity prices, the following conclusion can be drawn: Bitcoin miners increasingly demand renewable energy. From the point of view of the energy transition, this feature is thoroughly positive and can accelerate the transformation from fossil fuels to renewable energy.

In a further scenario, however, Bitcoin mining cannot only reduce the power surplus to a minimum and thus increase the economic viability of renewable power generation plants such as wind and solar, but also contribute to direct grid stabilization through the so-called provision of control power.

Providing grid stability with Bitcoin

Control power refers to the ability of power generators and consumers to adjust their power production or consumption to the fluctuating grid frequency within a certain time window in order to maintain the stable grid frequency of 50 Hz. For example, by making quick adjustments to the power output, a power generator can help keep the grid frequency stable. The same applies to consumers, who are able to adjust their power consumption according to the conditions of the power grid.

This is particularly important when integrating volatile renewable energies such as wind and solar power. When a sudden increase or decrease in electricity production occurs due to weather conditions, it can cause an imbalance between electricity production and consumption, thus affecting grid frequency. Integrating bitcoin mining as an electricity consumer into the power grid can help improve grid stability by allowing miners to act as virtual power plants and provide balancing power.

Overall, integrating Bitcoin mining into renewable energy systems has the potential to accelerate the transformation of our energy system. This is because mining can help minimize the surplus of renewable energy and improve grid stability. Companies and governments are therefore encouraged to explore the possibility of Bitcoin mining as part of their energy systems and use it as an opportunity to drive the energy transition.

What is the current status in Europe?

In the USA, especially in Texas, the enormous potential of Bitcoin mining as a network stabilizer seems to have been recognized. Regulations and legislation are already taking hold, and there is already evidence that Bitcoin mining works as a network stabilizer in practice.

In contrast, here in Europe, there are hardly any known operations using Bitcoin data centers for network stabilization yet. However, a few initial test bets exist in parts of Sweden, Norway, or Ireland (see further newsletter article) in partnership with transmission system operators.

Recent talks with European Bitcoin data center operators have shown that more and more are beginning to understand the potential of Bitcoin data centers as a grid-serving resource. The ball is now with RE system operators, transmission system operators and policymakers to seize this opportunity.

In this context, education is the most promising way to convince the aforementioned entities as soon as possible. Education, exchange and dialogue with all parties involved in this important topic of the energy transition is what is dear and near to terahash.space. As a newly founded company with this purpose, we act to bring Bitcoin and these energy topics closer together. In Europe and for Europe.

🔵 The Harmonisation of Bitcoin Mining & Energy

written by Mark Morton

The Bitcoin network's meteoric rise from a small community to the world's most secure decentralised monetary network has inevitably led to an increase in the energy protecting it. This increase in energy use has opened up a clear line of attack for Bitcoin sceptics that deem every kW of this energy consumption to be wasteful.

These arguments assume that all energy consumption is negative and the ECB has made it a priority in recent months to demonise Bitcoin mining. The most notable hit piece was a blog post late last year that insinuated Bitcoin and bitcoin mining have zero meaningful value for anyone.

This blog was riddled with vague and ill-informed arguments against mining which are worth addressing prior to exploring the various valuable use cases of Bitcoin mining. The basic and crude comparisons to country energy usage we see do not paint the full picture of this new innovative energy process. Firstly, these traditional reports do not distinguish between on or off-grid mining. These statistics are usually derived by estimating energy consumption from the current total global hash rate and their associated emissions via IP address and the grid mix of that region. They glaringly ignore that Bitcoin mining has been evolving with sophisticated off-grid and on-grid mining solutions emerging to not only power Bitcoin in a cost-effective and sustainable manner but to provide a valuable integration to existing power systems and grid infrastructure. The benefits of the strategic and innovative use of Bitcoin mining as a flexible and location-agnostic energy asset are consistently overlooked.

It's also worth addressing the constant references to e-waste per transaction which is a nonsensical and flawed statistic. The energy required to produce the Bitcoin network’s global hash rate is not directly correlated to the number of transactions occurring, a block will be mined approximately every ten minutes whether that block is full of transactions or empty. The constant narrative that there is a direct correlation between e-waste and the number of times I and another individual send each other Bitcoin is laughable. This is all before we even begin to explain that the “slow and cumbersome” transaction ‘throughput’ figures these individuals use are most likely only looking at the base chain as to them ‘lightning’ is just something that you see before thunder. Finally, the majority of Bitcoin mining e-waste critics assume that mining machines have a lifespan of 2-2.5 years after which they are dumped, tell that to the miners that in 2022 were still running S9s off of flare gas and reducing methane emissions six years after their release. The dawn of intermittent mining with renewable sources will also see new machines transitioning from high uptime sites to lower uptime ‘soakage’ sites after a few years as miners look for a lower capex setup to offset their lower uptime. Now that that’s out of the way, let us dive into some real-life examples.

Bitcoin mining’s key role

Grid operators around the world are slowly coming to the realisation that Bitcoin mining can play a key role in balancing heavily renewable grid systems. Bitcoin mining is a flexible and instantly interruptible single-process energy consumer. It allows hundreds of megawatts of energy consumption to be shut off in seconds, which can then stay off for an indefinite period of time. Renewables by nature are intermittent and mining can play a key role in ironing out the peaks and troughs of renewable generation.

Ireland has 300+ wind farms and ambitious goals to reach 70% renewable generation by 2030. Based on its’ modelling of impacts and feasibility, the Commission is proposing to increase the target in the Renewable Energy Directive to 45% by 2030, up from 40% in last year’s proposal. This would bring the total renewable energy generation capacities to 1236 GW by 2030, in comparison to 1067 GW by 2030 envisaged under Fit for 55 for 2030. Flexible on-grid demand assets like Bitcoin mining should play an integral role in this buildout.

The Why?

There are two types of electricity generation: synchronous generation and non-synchronous generation. Synchronous generation produces the same amount of electricity all the time. It is reliable and predictable and, therefore, easy to bring onto the grid.

Non-synchronous generation produces a different amount of electricity depending on the energy available. It does not produce the same amount of electricity all of the time. This makes it less reliable, and more difficult to bring onto the grid. Most renewable forms of energy, such as wind and solar, are types of non-synchronous generation. This is because the amount of wind is always changing and therefore they cannot produce power predictably.

In Ireland, there will be times when it is not possible to accommodate all renewable generation while maintaining the safe, secure operation of the power system. Security-based limits have to be imposed due to both local network and systemwide security issues. It is necessary to reduce the output of renewable generators below their maximum available level when these security limits are reached. This reduction is referred to as the ‘dispatch-down’ of renewable generation.

Constraint: There are wind farms all over Ireland but the majority are along our southern and western coasts where wind conditions are best. This means on a very windy day a lot of electricity is being generated but what happens if there is so much electricity that there is not enough capacity on the power lines to transport it where it must go? When this happens there is a constraint on the transmission system, similar to a traffic jam on the roads. There is no problem producing the electricity, there’s just no way to transport it. To ensure the safe operation of the system one or more generators are instructed to shut off or produce less power to ease the bottleneck. This is done to ensure that the transmission lines don’t overload and become damaged. We say when this happens to a wind farm that it has been ‘constrained’ and this is the most common form of Dispatch Down.

Curtailment: Curtailment occurs because of the challenges of incorporating renewable electricity onto the transmission system. The best-known form of curtailment is the SNSP limit, short for ‘System Non-Synchronous Penetration’. Ireland’s electricity system, like most other systems in the world, operates at a frequency of 50 hertz. Ensuring that our frequency levels stay steady is probably the single most important priority in managing the electricity system. EirGrid, Ireland’s state-owned grid operator, has put in place the SNSP limit to ensure that the volume of wind energy is manageable. The limit is currently 75% percent which means that even on a very windy day when the wind could provide 80 or 90 percent of Ireland’s electricity it is not allowed to do so and wind farms are dispatched down until they hit the 75 percent limit.

How prevalent is this issue?

In Ireland in 2019, the dispatch-down energy from wind resources was 711,000 MW (6.9% of the total available wind energy) - a total overall increase of 254 GWh in dispatch-down energy compared to 2018. Lost wind energy rose to nearly 11.5% of total production in 2020, the equivalent of 1,400,000 MW of electricity. Wind farms lost €75.5m worth of revenue in 2019 - up from €49.7m in 2018 - because they were forced by EirGrid to either switch off completely or turn down their power output to the national grid at certain times, according to a report from the Irish Wind Energy Association

Taking the US as a role model

ERCOT, a company operating Texas's electrical grid, has become the front runner for incorporating bitcoin mining into their grid ancillary arsenal. In Q1 last year, ERCOT generated a record 34% of their power output from wind and solar. The ex-CEO of ERCOT Brad Jones has repeatedly cited the benefits mining offers for grid flexibility, stability, and security. Riot Blockchain based in Rockdale, Texas is a prime example of the relief mining operations can offer the grid. This year Riot shut off the entirety of their 450MW facility during winter storms and a summer heatwave to allow their energy allocation to be used elsewhere.

Lancium, a Texas-based Bitcoin miner has provided further research on the benefits of flexible demand assets like Bitcoin mining and states that these assets lead to a net decarbonisation of grid systems. The ideology stems from the optionality that mining can bring when renewables are under-producing. High-carbon generators like gas turbines and coal plants would no longer have to switch on as mining can simply cut demand to bring the grid back into equilibrium.

The International Energy Agency has stated that in order to meet global 2050 net zero goals, grid systems globally will need approximately 500GW of demand side assets. The Bitcoin network currently consumes around 11GW and as such we could fit the entire network into this rapidly expanding market many times over. Common narratives would lead you to believe that Bitcoin will hamper energy production but it is clear that mining is solidifying its place as a key grid ancillary that will allow the rapid expansion of renewable infrastructure.

Bitcoin mining reduces methane emissions

Anaerobic digestion will also benefit from the location-agnostic revenue that mining can offer. There are 135,000 farms in Ireland. Agriculture is responsible for 37% of Irish emissions (Environmental Protection Agency data), while 80% of emissions from farming are methane related.

Small-scale anaerobic digesters (SSAD) can play a role in reducing Ireland’s agricultural emissions with Cycle0 recently entering Ireland with a view to expanding this smaller-scale technology. Containerised bitcoin mining is location and grid agnostic and creates a constant buyer of remote energy that can aid the expansion of decentralised small-scale electricity generation.

Bio-energy generators have previously been restricted on where they can base their operations given the need for a steady flow of input waste and sufficient electricity export capacity to the grid. Mining can improve the payback for larger-scale renewable generators by allowing them to maximise output irrespective of grid export capacity and could be the catalyst for more decentralised and efficient anaerobic digester buildout. Anaerobic digestion and Bitcoin mining are already combining on farms in Ireland utilising Scilling’s containerised solution. This is a match made in heaven for small biogas plants that are set up in isolated regions to make use of ‘stranded feedstock’ with inadequate local grid infrastructure.

Mining optimises electricity generation & efficiency

Electricity generation by nature is simple. The transmission and efficient use of that energy is where issues arise as mentioned regarding ERCOT. While mining can be a critical part of grid infrastructure on a large scale, we are also seeing it implemented in behind-the-meter and off-grid solutions.

These unfussy & location agnostic energy consumers are facilitating the onboarding of renewable generation in locations where grid capacity delays are hindering renewable buildout like we are seeing in parts of Portugal. Mining can be collocated with renewable assets to optimise the full energy capacity that cannot be exported. The use of mining as a location and grid-agnostic revenue stream can be the potential missing link in renewable projects bypassing grid capacity issues in Europe and ultimately making it to market.

Bitcoin mining will continue to surprise the critics

Critics have long been obsessed with the network's total consumption instead of the characteristics of its consumption. It is worth acknowledging that Bitcoin’s energy consumption will continue to grow. However, the various mining techniques mentioned above could be the catalyst for a change in the Bitcoin mining narrative.

The EU has set out very optimistic renewables goals and while mining is by no means the silver bullet to onboarding this generation, it certainly has a strong point for inclusion in the conversation. In this article, we have tried to demonstrate that mining should not be seen as unfeasible in Europe, as the models we see being utilised in the US can and will be utilised here in time as the education and knowledge of mining improves.

c

🟡 Blockchain & Sustainability

written by Casper van der Elst

A new hype is about to get started in the blockchain arena. This time it’s around sustainability or ESG (Environment, Social and Governance). One of the new terms is ReFi, which stands for regenerative finance and aims for a financial system that places sustainability over financial gain. It’s true, blockchain can play a significant role in promoting sustainability by improving transparency, accountability, and efficiency in various industries and sectors.

Conversations about blockchain & sustainability also often divert to the negative energy effects of bitcoin mining. However, this underestimates the complexity of the blockchain universe. Not all blockchains require energy-intensive mining and even if the consensus methodology requires a lot of energy, then it’s not necessarily wasted. Beyond bitcoin, as a decentralized currency, blockchain opens a number of use cases that are not possible with centralized databases. Therefore, in reality, blockchain might be a sustainability enabler. In order to become more sustainable, we will partly need to rely on blockchain technology.

What projects are there?

Let’s directly get into a few real examples. There are 2 websites that can be recommended for inspiration on what blockchain can contribute to sustainability. The first is positiveblockchain.io, which is a platform that provides information about projects that use blockchain for good. They maintain a database with currently 1230 projects in it. The database shows the name, description, location, year of creation, and website. There’s also a column that shows if the project is active (currently 576 inactive) and an indicator of which blockchain is used. Very interesting is that each project is associated with one or several SDGs (Sustainable development goals) as defined by the United Nations. If a project contributes to healthcare, then it shows number 3. Unfortunately, there’s no review of the projects, which means that the list most likely contains a mix of high- and low-quality projects.

The second website is cryptoaltruism.org, which is a platform that provides articles, infographics, and podcasts about altruistic crypto projects. This platform is very active, and the infographics are good for sharing on social media. There are currently already 93 podcasts recorded and 1 or 2 are added each week.

Judging by these 2 websites, we can see that there’s a lot of activity in this space. Nevertheless, if we look deeper, then the contribution to sustainability becomes questionable. Let’s take Moss.earth as an example. Moss is a carbon offset platform, with a token called MCO2. 1 MCO2 token equals 1 ton of CO2. By buying the tokens, Moss claims that users are combating climate change. The proceeds would go to reputable environmental projects. But in reality, the CEO Luis Adaime called himself the Wolf of the Amazon and sold tokens for up to nearly eight times what it had originally paid to developers, making a stellar profit for themselves. At best, this project had good intentions, but at worst, it was never designed to combat climate change at all. It’s likely that crypto firms like Moss are chasing quick returns to pay back investors and puts the credibility of the market at stake.

In order not to fall for scams, there are a few red flags to remember. To make a real sustainability contribution, someone in the project needs to have subject matter expertise. If the team consists of people with only a finance or a technology background – this is most likely not a good start. Other indicators are an aggressive focus on immediate buying, extreme bluffing (also called virtue signalling), and little explanation of the operational process. A practical tip for investors: It often helps to join some of a project’s social media channels and ask some detailed questions.

A new technology: blockchain

A public blockchain is a global decentralized ledger that records transactions or processes with a predefined consensus. It works similar to a database but has no central point of attack and is therefore incorruptible. The data recorded in public blockchains is visible to everybody with an internet connection through blockchain explorers. Some blockchains use a lot of energy, but most of them don’t. For example, Ethereum has recently upgraded to the less energy-intensive proof of stake consensus.

In a nutshell, public blockchains provide a global, incorruptible, transparent database. It puts pressure on centralized processes, because if they don’t perform well because of transparency or corruption, then people have a working alternative. This doesn’t mean that the decentralized option is by definition better, but it provides a plan B in case plan A leads to a dead end.

Time for alternative organizations

With the numerous great projects that are started to promote a more sustainable future, are we maybe treating the symptoms, but not the disease? It’s unlikely that ESG problems will be solved within the current organizational structures (government or private) because of the following reasons

Lobbyists and corruption

Politicians are used to negotiation and concessions, whereas the framework of global environmental stability is non-negotiable.

Law enforcement for many illegal activities is not taking place

Legal prosecution comes after non-reversible facts have already taken place.

Legal action takes years

Differences between jurisdictions

Space without jurisdiction (like the oceans)

If legal constraints become uncomfortable in a jurisdiction, then it will move to other jurisdictions.

Powerful leaders can organize meetings to agree on good intentions, but execution counts, and it seems to be unsuccessful. The Paris Agreement nor the COP26 Climate deal are likely going to make the difference we need to prevent 1,5 degrees or even 2 degrees by 2050. Also, Sustainable Finance is not likely to make a real difference, because, within the current frameworks, it’s too easy to escape from uncomfortable truths. By 2030 we will conclude that the implied regulations were too free in form.

The current problem we face

The problems that we face with ESG implementation looks like a prisoner’s dilemma on the individual, company, and country level. If participants all cooperate, then they will all equally benefit, but if participant 1 cooperates where participant 2 refuses, then participant 2 will benefit from participant 1 without making any sacrifice.

If we look at the SDGs as defined by the UN, then there are numerous items that any company can contribute. For example, to contribute to SDG13, country A could charge a heavy carbon tax to limit the number of carbon emissions of that country. But if country B doesn’t implement the same strategy, then the products of country A will have a competitive disadvantage compared to country B because it doesn’t have to pay the tax. This prevents any participant to be a first mover and opposes fair play. Similar dilemmas can be imagined for other SDGs on the company and individual level.

A fair system would charge equal global taxation with traceable contributions. To avoid confusion, this would only apply to taxes related to sustainability, every country can apply its own additional layers of taxes. This kind of organization for global taxation needs to be incorruptible, there should be no single representatives that can be influenced or extorted. This needs to be an organization that enforces rules immediately and doesn’t make concessions. An organization where individuals, companies, and countries can commit to solutions without the risk of being exploited.

The required kind of alternative organization can be implemented on a public blockchain. It doesn’t belong to any nation, but the rules can be defined in global cooperation and the code can be open source so that the rules are provably fair. It will become immediately visible which contributors are defecting and there will be no excuses. All participants are encouraged to contribute, and the biggest contributors will have a competitive advantage because of this visibility.

Sustainability-enabled tracking system

We have reached the point where consumption cannot grow much further. At least not on a global scale. The most successful companies have aggressive strategies to continue growth, whereas this goes at the cost of natural resources that are needed for the next generations to survive.

The problem of resources is global, but we are organized by nation. That has logical historical reasons. The only way to get organized before we had computers, was to cooperate with groups of people and appoint representatives. Eventually, those groups became countries with their own laws and currencies. That makes sense, but now we have the internet and the possibility to create global systems, so why don’t we?

In order to make the right decisions, we need to visualize and compensate on a global scale.

Below is a set of minimum requirements for such a sustainability-enabled tracking system:

Rules and systems must be globally implemented to prevent leakage at any point in the world, also on the oceans

Rules and systems must be equally applied to all people on the planet to prevent the consequences of the prisoner’s dilemma

The result must be measurable and visualized so that we have an immediate feedback loop to take measures

A solution for a sustainable planet has to tick all three minimum requirements in order to succeed. Blockchain technology is in a unique position to fill this gap because a public blockchain cannot be controlled by any government. It cannot be manipulated or corrupted and is updated in real-time. Everybody with internet can access this global system and see the transactions of the system.

The sustainability-enabled tracking system can be used to keep track of commodities including oil, precious metals, and crops. But we can also track clothes, meat, and electronics with little effort. The benefit of immediate visibility is that we can respond much quicker to deficits and surpluses. It may sound impossible to implement, but the same was said about a live overview of COVID infections and we got pretty close in a short timeframe.

Tokenized carbon credits as a UBI

UBI stands for universal basic income which is completely unconditional. In his book Utopia for Realists, Rutger Bregman carefully explains the benefits of UBI. There have been numerous blockchain projects experimenting with UBI, but most of them fail because there are many people on the sell side, but few on the buy side. What if the proceeds of carbon taxes would be used to distribute a UBI in crypto tokens?

In practice, every human that would like to receive a UBI would need to register in a Sybil proof list of humans, similar to proofofhumanity.id. They need to have a wallet address to receive the tokens and education on the actual workings. Non-profit organizations can help to subscribe to carbon credits in poor areas, to prevent them from doing harmful things (like child labor, clearing forests, or overfishing) to earn money to survive.

Do we have a blockchain that can accommodate a UBI on such a scale? Public permissionless blockchains based on proof of stake are most likely the best option for mass distribution of tokens. Stablecoins could be used to prevent wild fluctuations. As Ethereum has recently moved to proof of stake, it doesn’t have the energy use of Bitcoin, while maintaining a good level of security. Once sharding has been implemented, Ethereum probably has the best scalability options. There are also a few other blockchains with the capacity and low transaction fees to accommodate such monthly transfers, but none of them is as credible as Ethereum.

Of course, not everybody participates at once, but if there’s free money, then it’s likely that people will be interested. If it’s working well, then the network effect will do the rest. A blockchain-based UBI financed by carbon taxes fulfils all three criteria. It’s a global system, it’s equal to humans in all countries. The result is measurable because carbon taxes and UBI paid are tracked in real-time.

Once the basic structure has been built, small initiatives can start everywhere. There will be a market gap for small companies in western countries that contribute to the initiative because individuals have the feeling that they pay a fair price for carbon taxes, while contributing to the reduction of poverty (SDG1) and reduced inequality (SDG10).

If there is a reliable carbon taxing system, then countries can draft local laws and policies that obligate to pay carbon taxes. Countries with these laws only do business with other countries that pay for their carbon emissions and the system will snowball from individuals to companies to countries.

Conclusion

There are numerous blockchain projects with a focus on sustainability. Blockchain has the properties to solve some fundamental problems of ESG-related aspects, but we do need to be careful about cases of greenwashing. While this article explained three use cases that might make a difference one day, there are numerous other options. There is still hope that blockchain can actually be a sustainability enabler and we should not dismiss it as a wasteful trend.

About the author: Casper van der Elst has an MBA International management, CFA Certificate in ESG Investing and is a Certified bitcoin professional. He has been working in private equity and hedge fund operations since 2006. His first blockchain experience was in 2015

🟢 The Social Side of Bitcoin

written by Joel Kai Lenz

Bitcoin’s true foundation lies in the grassroots movement. You see this with everything in the ecosystem, whether that be your favorite hardware wallet or your go-to place to buy some.

All of these endeavors have at one point been a passion project by fellow Bitcoiners, or it was a collective who wanted to solve a particular problem in the market.

Bitcoin celebrated its 14th birthday on January 3rd, and just like any teenager, it’s getting more interested in the social side of things. The days when Bitcoin was a small thing within a developer community are long gone.

Don’t get me wrong, these developers are still around, but Bitcoin has become a social phenomenon, and more communities are interested in it.

Bitcoin has become more approachable for different groups

Although it’s not a favorite amongst Bitcoin maximalists, the most recent one is the Bitcoin NFT community. Since Ordinals came onto the scene in January, more NFT collectors have come on board and discovered the world of Bitcoin.

This group of newly minted – see what I did there - Bitcoiners are not interested in the block size debate or how to improve Bitcoin. They just want to have fun with their images.

Another example would be merchants, especially shops in smaller villages or cities. They might be interested in the Lightning Network. Not because it’s a layer two solution on top of Bitcoin and the way forward to achieve worldwide scalability.

NO! They’re interested in the low fees and speed of it all. If they save the 3 to 5 percent in fees they usually pay to Visa or MasterCard, they will be able to grow their businesses faster or have more savings.

It’s all about putting Bitcoin on the map!

The more people we find that are interested in Bitcoin for all the different reasons, the better. Just like Bitcoin aims to solve the problem of centralization, we also need more diverse opinions and decentralize the Bitcoin community.

One way of doing this is through Bitcoin meet-ups. These are the original marketing hack of how early Bitcoiners grew the community. Either by creating an event on social media and inviting everyone to it, or by using platforms like Meetup.

If you go to their website and look for the next Bitcoin meet-up in your neighborhood, you might be surprised as to how many people around you are also interested in it.

These events are a great way to meet new Bitcoin friends, hear different opinions, and often learn a few new ideas on how to use Bitcoin. Speaking from my experience, it’s also a great way to meet your future co-host for your next Bitcoin podcast. Don’t be timid and look for the next events.

The Bitcoin-only social circle is growing at a fast rate

Meeting IRL is not for everyone. Some of us don’t have the time or are not interested in screening meet-up websites for hours. If this is you, and you feel lost, don’t worry! There are several online communities where all they talk about is Bitcoin!

One of the easiest solutions is to join something like Bitcoin Reddit with their community r/Bitcoin. It’s a vibrant community where you have the chance to talk to fellow plebs all around the world. It’s also a great resource to stack Bitcoin memes.

Next to Reddit, there is also the original Bitcoin Forum, which is still active to this day. If you’re a Bitcoin history fan, you can even go back and read Satoshi’s posts there. It has cooled down since its launch in 2009, but it’s still a great place to meet fellow Bitcoiners.

If forums aren’t your thing, and you seek something similar to Twitter, you might like nostr. It’s the newest place where all the Bitcoiners hang out.

Nostr is unique because it’s not a centralized social media platform or forum. As a matter of fact, it’s not a platform at all.

The name of the decentralized protocol stands for “Notes and Other Stuff Transmitted by Relays,” and it allows users to send their content through a network of relays.

Through that, it’s censorship-resistant because the user is always in charge of their content. If they don’t like the rules of one relay, they can change to another one or choose to run their own.

You also have the option of how you want the network’s content to be displayed. There are several different clients with which you can work. Like in Bitcoin, you can connect to all of them using your private and public keys.

But what sets nostr apart is its latest updates with Zaps. They’re a specific way to tip fellow creators or people you follow on nostr via the Lightning Network. Instead of collecting countless likes on social media, you can now earn something.

A lot is happening on nostr, and it feels like the Bitcoin hotspot. If you like to contribute, head over to nostr.how to learn how to create an account and start with nostr.

Last, but definitely not least, I would love to mention the Orange Pill App as well.

First off, it’s not a dating app! It’s an excellent solution to meet fellow Bitcoiners in your area. You can download the app from the Apple App Store or Google Play Store and create an account within seconds.

Once you’re logged in, you’re immediately greeted with a simple interface. You’ll need to enable your location to access most of the features.

Once you’ve done that, you’ll be able to look for fellow Bitcoiners in your area, and you’ll be able to connect with them. If they accept you, a dedicated chat opens, and you two can discuss everything. There is also a function where you can search users by their name or be on the lookout for Bitcoin merchants near you!

Which is something the Orange Pill App team is currently working on. In partnership with BTCMap.org, they’ll be displaying merchants near you and enable these merchants to advertise directly in the app.

They’ll also enable Bitcoin events near you, which means you no longer need to surf the internet, but just sign up for the Orange Pill App and see what’s happening around you. This could be huge for merchants as well, as they would be able to use this feature and be present in their community as well.

The Orange Pill App is more than a place where Bitcoiners hang out. With future updates, it could become the hub for all of your Bitcoin talking, meeting, and spending.

Bitcoin is so much more than the price!

These few solutions prove that the Bitcoin community is much more than the current price. Yes, for most newcomers, the price is their first introduction.

However, once they invest a bit more time and get to know the social side of Bitcoin, they’ll quickly discover that it’s open to everyone and will have something in store for each and every one!