Waiting for Godot... or the FED

Market Update, Liquidity Corner, Asset Rush, Lightning versus Visa, Three Problems Token Streaming Solves, Crypto in Istanbul

Let’s gooo 🎢 What to expect:

Knowledge-Level : 🟢 Beginner| 🟡 Advanced | 🔵 Expert

Insight DeFi on Social Media: LinkedIn / Instagram / Twitter / YouTube / Telegram

🟢 Market Update: Wait for the Fed to give Bitcoin a license to fly

written by Pascal Hügli

A look at macro

The macro-environment, and thus the situation for investors, is currently more difficult than it has been for a long time. This is not only what we at Insight DeFi claim, but also what the renowned hedge fund manager Stanley Druckenmiller argues. He recently said that the current market environment is the most difficult he has experienced in the past 45 years.

Bitcoin is currently hanging in there. After the cryptocurrency failed to break the $30k barrier after attacking it several times, the price has corrected back down a bit. However, one cannot speak of a dump—not yet, some would argue.

Professional market observers currently believe that prices are likely to fall sharply again soon. The main argument cited is the situation surrounding the drying up of liquidity in the TGA and the upcoming U.S. government bond issuance mania, which is likely to suck considerable financial liquidity out of the markets (see Liquidity Corner).

Banks at the Origin of a Malaise?

However, it is also argued that banks are becoming more cautious when it comes to lending to each other. Proof of this is the recent explosion in the risk premium for interbank loans:

This might have an impact on bank lending going forward, as banks are likely to increasingly withdraw from lending to consumers and companies. The insolvencies of regional banks in the USA are not exactly helpful in this respect either.

A ripple effect of this could be a general deleveraging, which would mean that total debt declines. And yes, when debt is declining in our credit-based financial system, the "money supply" is also declining. Less money to "work with," could then result in more bankruptcies and a deepening of the recession, which would be undeniable at that point.

Employment figures: Tipping the scales

Should things really develop in this way, company downsizing and collapses would eventually drag employment figures down. The first signs in this direction can already be seen. Moreover, employment figures have always proven to be an excellent recession indicator. This is one of the reasons why the U.S. Federal Reserve considers the employment level to be so important and is currently making its further action dependent on it.

"Preprogrammed" and pre-programmed

With the storm brewing, some investors believe that assets, especially risk assets like cryptocurrencies, will take another hit in the coming months. However, if this is indeed the case and the economy contracts badly, the US Federal Reserve will have to intervene at some point.

Others are speculating on this. And the market is already pricing in such scenarios. The majority of market participants now expect that interest rates will not be raised again in June. And with each month that passes, expectations are even tending toward the possibility that we could see interest rate cuts as early as the fall.

Because if you look at all the Fed's interest rate hiatuses since 1980, you can see that the Fed has only been able to keep interest rates at their peak for an average of just under 5 months in the past. So if May was indeed the peak (we'll know in June), then the clock is starting to tick and reductions could indeed be on the horizon in October. It seems as if the next central bank-induced liquidity boost is already "pre-programmed".

If the US Federal Reserve will then also have to deviate from its QT policy in order to resuscitate the economy with new financial liquidity in addition to the interest rate cuts, risk assets, first and foremost Bitcoin, will react to this heavily. From an investor’s perspective, the cryptocurrency is particularly exciting at this point then, because the upcoming May Bitcoin halving with the pre-programmed supply halving will be very close by then. And note: The bitcoin correlation to the stock markets is already falling, which can only mean one thing: The crypto asset is waiting for the day when it can start an epic run again due to macroeconomic conditions.

News from the crypto world: BRC-20 paves the way for assets on bitcoin

BRC-20 tokens are all the rage. Based on the Ordinal protocol, a developer called Domo has created the ability to create fungible tokens on the Bitcoin blockchain.

By assigning arbitrary information to certain Satoshis (Sats), the BRC-20 tokens can be created (more on this in our video market update from April). To date, there exist mainly meme tokens on the Bitcoin blockchain, which are exploited by speculators. However, the actual potential of these Bitcoin tokens should not be underestimated. Lightning Labs is also of this conviction. The company has therefore recently launched a better version for launching assets of all kinds on Bitcoin.

The project, which started under the name Taro by Lightning Labs, has now been renamed "Taproot Assets". This solution is currently still on testnet, but the version seemingly already has all the functionality to launch stablecoins on the Bitcoin blockchain. So, onto the Bitcoinization of the dollar.

Is Tether the new MicroStrategy?

Speaking of stablecoins, the largest US dollar stablecoin Tether, meaning the company behind it, has announced it will regularly use up to 15% of its realized profits from investments to buy BTC in the future and add the coins to its reserve surplus.

In the first quarter of this year, Tether posted a record net profit of $1.48 billion. This means that the company posted higher Q1 profits than companies such as Netflix, Paypal, Starbucks, or Cash App - a fact that is probably also due to rising interest rates environment. This benefits Tether, since the company primarily holds interest-bearing securities on its books.

Now some are already speculating that Tether could be the new MicroStrategy. The publicly traded company certainly helped fuel the bull market of 2021 with its repetitive buying. Could Tether spark similar momentum again with its regular buying? Critics tend to complain that we've already had a stablecoin buying bitcoin once in the past - the Luna Foundation Guard (LFG) and that ended in disaster, as we all know. But maybe, this time around the timing could be better. We will see.

Tricky wallet situation

Ledger, probably the largest hardware manufacturer, has recently felt the wrath of the Internet. You can see how that manifested itself here and here, for example. Why the shitstorm?

The company has announced a new optional service with its latest firmware update: Ledger Recover - a key recovery service. And it works like this: The seed phrase (i.e. recovery phrase) is encrypted and split into three parts. These parts are then held on different (central) servers, one of which is also at Ledger. If a user wants to recover his cryptos because he has lost his access key (seed phrase), he can apply for it via these servers. All that is required is to confirm one's own identity.

What sounds like an interesting service that increases usability, of course, has its trade-off in terms of security at the same time. If the seed phrase is not only stored on the hardware wallet, the attack vectors increase. The matter also has a stale aftertaste because the personal data of Ledger users has already been leaked to the public once bofre in a hack.

However, the case is mainly problematic because the Ledger company does not seem to be very accurate with the truth. It has always been assured that a seed phrase cannot leave a user's personal hardware wallet device. Now, this seems to be possible with this new update.

If Ledger now asserts that the innovation still does not enable a back door, it is uncertain whether this statement can really be trusted. Especially since the Ledger code for the hard wallet is also "closed-source", experts from outside have no insight, which increases the need for trust on the part of the users.

As a long-time Ledger user, you don't know whether or not the new feature is actually opt-in or you could actually fall victim to misuse. Until all questions have been clarified, it is therefore advisable to switch to good, alternative hardware wallet solutions. These include: Bitbox or GridPlus.

🟢 Liquidity Corner: Headwind is preprogrammed

written by Pascal Hügli

Net financial liquidity in the U.S. (with the BTFP emergency lending program).

May 05 (past newsletter issue): $6,089 billion

May 18 (current newsletter issue): $6,195 billion

↗️ Increase of $106 billion.

Broken down even further here:

Total balance sheet* of the Federal Reserve:

May 03 (past newsletter issue): $8,500 billion

May 17 (current newsletter issue): $8,456 billion

️↙️ Reduction of $44 billion

Reverse repo programs in the U.S.

May 05 (past newsletter issue): $2,207 billion

May 18 (current newsletter issue): $2,214 billion

↗️ Increase of $7 billion

U.S. Treasury General Account (The U.S. government's "bank account" at the Federal Reserve).

May 05 (past newsletter issue): $207 billion

May 18 (current newsletter issue): $95 billion

↙️ Reduction of $112 billion

Over the past two weeks, overall liquidity in the U.S. financial system has increased again. While BTFP loans have increased slightly, it is primarily the reduction in TGA that has flushed liquidity into the market. Last Monday (15.5) alone, the U.S. Treasury withdrew $52 billion from its bank account and transferred it into the market.

The U.S. government currently has to empty its bank account to such an extent because it has reached its debt ceiling and, until politicians renew the permission, government is not allowed to go further into debt.

In the last issue, we already mentioned that the U.S. government's bank account with the Federal Reserve will soon be depleted and that this liquidity booster will thus cease to exist. Now that the money seems to be running out, Janet Yellen, the woman who is responsible for spending US government money, has recently spoken out. She warned that a U.S. bankruptcy would severely shake the global economy. So, in her eyes, it's all the more important that U.S. politicians come to an agreement and allow the government to borrow again.

This authorization, as always in history, is thus likely to follow soon. Once the debt ceiling is lifted, the U.S. Treasury will issue $1 trillion worth of bonds by December. This trillion US dollars must come from somewhere. Or put another way: this is financial liquidity that (must) flow into bonds and cannot flow into risk assets (such as crypto assets)....

In liquidity terms, therefore, a huge TGA headwind is soon in store for risk assets. This could be countered by an expansion of the balance sheet, i.e. the Fed would have to move away from its QT (quantitative tightening) strategy and thus expand its balance sheet again, which would improve liquidity conditions via this channel. Changes in the Fed's balance sheet therefore need to be monitored particularly closely to assess the liquidity situation in its entirety.

🥳 Meet Insight DeFi at AssetRush

The Insight DeFi team is back in Switzerland and of course already present in the midst of crypto people again. Next week, we will be at the upcoming AssetRush event on May 23 in Zurich.

Of course, we would be very happy to meet as many of our readers as possible live and AssetRush is a great place for this.

The event is organized by GenTwo. Professional investors and all kinds of pioneers from the financial world will come together on this day. The event is already in its sixth year and it even has global reach.

At this year's event, 15 national and international innovative projects will present themselves on stage. In addition, there will be plenty of time for connecting and networking. And also worth mentioning: This time, the whole thing is also supported by RealVision, a go-to place for macro and crypto content. Insight DeFi knows RealVision very well, of course, having already actively supported the company as a content agency on the crypto side of things.

You can order your discounted ticket right now via this link. See you there!

🟢 Lightning versus Visa: What you need to know!

written by Sebastian Strub

The Lightning network is a scaling solution for the Bitcoin blockchain. To ensure maximum decentralization and thus resilience for users, the Bitcoin protocol makes some compromises. For example, the blockchain can only process relatively few transactions. Lightning solves this problem. It enables real-time global Bitcoin payments for low cost.

What is Lightning?

The Lightning network consists of channels through which payments can be sent. For this purpose, a certain amount of bitcoin is locked in a 2-party address ("multisig") on the blockchain. Now the two parties can make payments to each other without using the blockchain. Nevertheless, lightning payments are final. At any time, one of the parties can cancel the joint account by publishing the last state of the channel on the blockchain.

Lightning achieves scaling through the ability to hop across nodes (routing) and thus receive payments from or make payments to parties with whom no shared channel has been opened. Recipients and payers are not determinable by nodes and outsiders, so Lightning ensures a high degree of privacy.

The network is still in a very early phase with an uncertain outcome, but a lot of innovation. There are numerous apps like Wallet of Satoshi or Breeze that you can get in minutes.

Lightning advantages

Lightning is the only global payments infrastructure where anyone can realistically be a full-fledged bank - sending, receiving, and mediating payments. A fee can be charged for this service that is proportional to the capital invested. The low barriers to entry create a competitive market.

This is why Lightning is very attractive, especially for small amounts: There are no basic fees. Even amounts below one centime are processed without prohibitive costs.

Quite the opposite of the existing financial system. Because of the complex processes and parties involved (see chart), the fees are high. Small amounts are impractical: Ask a baker how much she earns on two buns sold. The answer will be sobering.

Limitations

Lightning is still hardly used outside the Bitcoin scene. Most crypto wallets have not even integrated it yet. Few merchants accept it, also because few controllers have yet dealt with crypto. A few functionalities are still missing on the protocol level, but above all, there are still too few simple and secure solutions for private individuals and companies.

Just try it out!

The good news is that intensive work is being done on all these problems. Especially in Switzerland! Get a Lightning payment card from Swiss Bitcoin Pay, for example. Visit beautiful Lugano and pay digitally for the first time in your life without intermediaries in many stores in the city.

The start-up Lipa is ensuring that more and more merchants accept Lightning. The hackers of the Lnp-Bp Association are developing solutions to send stablecoins via Lightning and to execute complex smart contracts via Lightning. In this way, Lightning could form the backbone for a modern open-finance ecosystem:

About the author:

Sebastian Strub is Business Engineer and Product Manager Payments. He has been supporting companies in payments and data-driven product management since 2017. Fascinated by the innovation of decentralized consensus, Sebastian is particularly interested in the implications for the financial system and payments. He publishes articles on these topics on his website and other platforms.

🟢 Three Problems Which Token Streaming Solves

written by Sablier Team

Traditional payroll and token vesting suffer from three key problems. In this post, we will clearly outline each of these issues, and explain why token streams are a great fit to fix these.

Traditional payroll/vesting solutions require a lot of manual Input

Today, companies need to pay their employees. Many times, payments need to be made manually over a long period of time, requiring ongoing efforts from the treasury management team. Every month, the head of treasury will have to initiate a significant series of payments to compensate contributors, handle vesting for employees and investors. Sometimes, this is automated, but even then, the solutions offer these automations require fees, take time to set up, etc.

This is time intensive, is prone to errors, and offers a bad user experience for both parties. The organization needs to spend all that time handling the administration, making the payments etc… while the recipients have to wait for a month, quarter or sometimes even longer to receive their compensation.

Conversely, blockchain-based token streams only have to be set up once. You just have to provide the total duration of the stream (can be a month, a year, or even multiple years) and that’s it — there’s no further action needed from you again, ever.

Recipients receive their compensation gradually over time: every second they receive a fraction of the funds. This fits great for both parties. The organization only needs to spend time once, to set up all the streams. On the other hand, the recipients receive the funds gradually over time, allowing them to manage their finances as they wish.

Release Schedules Imply a Schelling Point for Speculators

On top of solving a lot of pain points when it comes to handling payroll, token streaming also offers a great solution to the speculation problems caused by release schedules. In game theory, a focal point (also called Schelling point) is a solution that people tend to choose by default in the absence of communication.

Since traditional vesting contracts have a predictable release schedule, the day on which a vesting period ends may be used as a Schelling point for speculators.

Certain recipients may intend on dumping their tokens as soon as they receive them. With blockchain-based token streams, recipients receive a fraction of the total payment every second and can thus withdraw a portion of funds at any time — in effect, this solves the dumping problem.

Direct Payments Lack Transparency

It’s hard to aggregate discrete payments, which is why they typically lack transparency. While anyone can check the blockchain and see the transactions being executed, it’s hard to figure out from looking at an old transaction on Etherscan to whom it was made, whether or not it was for payroll or vesting tokens, etc. While the data is public, interpreting it is hard. As a DAO, it’s especially important for your contributors to be able to see where the money is going and why.

These problems don’t happen with blockchain-based token streaming services. When the tokens are streamed, anyone can check their interface to monitor the status of a stream and all transactions associated with it.

Here is an example of a stream. As you can see, the interface provides a stream link which can be shared to the public to visualize the stream, an Etherscan link is also provided if you are looking to check the transaction status.

The interface also provides a complete transaction history, so that anyone can see when withdrawals were made, and what amounts were withdrawn from the streamed funds by the recipient. In short: transparency is native to blockchain-based streaming services like Sablier.

What Is Sablier?

Last but not least, here is a quick introduction to the Sablier protocol.

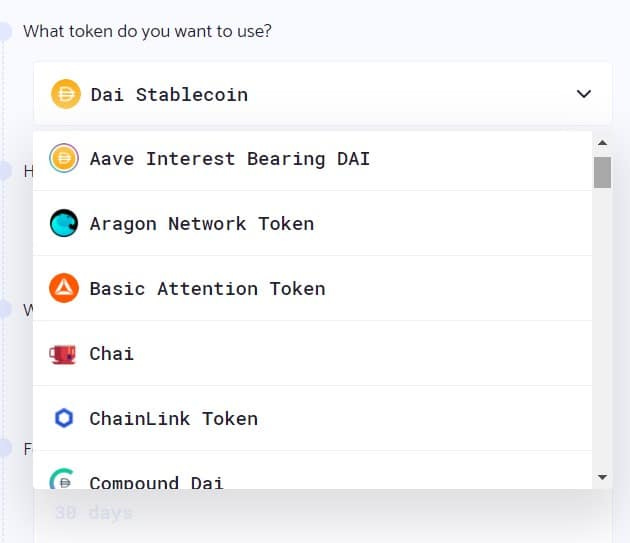

Sablier is a token streaming protocol available on Ethereum, Optimism, Arbitrum, Polygon, Avalanche and BSC. It is the first of its kind to have ever been built in DeFi, tracing its origins back to 2019. Sablier is being used by hundreds of organizations around the world like Compound, Shapeshift, Aragon and Astaria, to handle vesting, payroll, airdrops and more.

Similar to how you can stream a movie on Netflix or a song on Spotify, Sablier lets you stream money every second. Sablier’s battle-tested streaming protocol reached a cumulative TVL of $1.5B back in 2021, making it the largest token streaming protocol in the ecosystem.

Another prominent blockchain-based token streaming service is Superfluid. This is a great post by them, explaining why streaming tokens matters.

🟢 Crypto in Istanbul: A Janus-faced affair

written by Pascal Hügli

On its recent trip, the Insight DeFi team also ended up in Turkey, or more precisely, Istanbul. This is not least because the country, much like Argentina (post on that here), is considered a hyperinflationary country. Inflation is currently falling, but it is still considerable. Due to this initial situation, it was our expectation that we would find a similarly high interest in Bitcoin and cryptocurrencies in Turkey.

Arriving in the large Turkish city, the former Byzantine Constantinople, one did not notice anything at first apart from a few Bitcoin and crypto advertisements along the streets.

However, the interest in Bitcoin was noticed when we stopped into the local kebab joint for a real Turkish kebab. Before we even ordered the delicious meal, we asked the waiter if we could pay by card. Short and sweet he said: "With us everything is possible, cash, card and especially Bitcoin". It seemed to us as if he emphasized Bitcoin particularly strongly and the case showed: cryptocurrencies seem to be gladly accepted by some as a means of payment.

Crypto exchanges: a cryptic affair

However, as we noticed, very few restaurants advertised that you could pay with Bitcoin at them. It almost seemed that way: Even if you accept cryptocurrencies as a service provider, you wouldn't want to expose yourself too much with it.

It was all the more surprising when we found quite a few cryptocurrency exchanges in the city center around and in the Grand Bazaar itself. While you could buy lots of cryptocoins at some of them, most of them always had a very strong display of the US stablecoin Tether in addition to Bitcoin.

We have been told that Tether is particularly popular in Turkey. As in Argentina, it is mainly the young, tech-savvy generations who exchange their wages received as Turkish lira for the US dollar-denominated stablecoin via such exchange offices.

For us Westerners, these small exchange stores naturally seem a bit disreputable. As we found out, most of these exchange bureaus charge 1 percent transaction fees - unfortunately, we did not find out anything about the chosen exchange rate, where, as we know, you can earn money.

What was exciting was that many of these exchanges quoted a minimum trade amount of a few $1,000, which seemed rather high to us. In the end, though, we didn't know if such minimum limits only applied to foreigners. Because as we found out in Turkey in general: From tourists very much more money is demanded, no matter whether that is the cab driver, the bazaar seller and the tennis court operator.

What was also a mystery to us was how these crypto stores could simply exist. After all, when we arrived in Turkey and wanted to visit various websites like CoinmarketCap or the one of the largest Bitcoin exchange BitcoinTurk, we were denied. They were blocked and only accessible via VPN (we use Mullvad). Thus, it was and still is not entirely clear to us whether crypto-buinesses in Turkey are illegal or not.

Blockchain Conference: Insight DeFi moderates panel

Insight DeFi also participated in a blockchain conference in Istanbul. Namely, as a moderator for the panel: DeFi - Promising Use Cases and Risks. The bottom line of the panel discussion can be summarized as follows: DeFi is only Decentralized Finance if the core properties such as openness, permission freedom, censorship resistance, atomicity and programmability are preserved. Also, we can really speak of successful DeFi adoption when users hardly notice that they are interacting with DeFi protocols.

What was also particularly noticeable about this conference was that it didn't bring together the clientele we're used to seeing at events in Switzerland or Germany. Not only were the projects presented in the hall very focused on the immediate consumer (mainly mediocre gaming projects), but also their presentation and banners might come across as somewhat disreputable in the eyes of a well-conservative Swiss.

Nevertheless, the event could once again be classified as horizon-expanding, not least because of the many Russians and Ukrainians who are currently streaming out to all corners of the globe to escape the deplorable conditions in their homeland. As we were able to ascertain in several conversations, it is above all the neutral cryptocurrencies that simplify personal payments and savings for them, away from any questions of identity and origin - services that conventional fiat currencies can only offer them to a limited extent, especially at this time.

By the way: Last weekend the elections in Turkey took place. Christoph Bergmann from BitcoinBlog wrote an exciting article on this topic. He researched how Turkish politicians feel about Bitcoin. Very worth reading.